The best low float runners usually don't even run for the first 2 hours of the day, they gap up slightly and they just hold (they trap the shorts).. this is where shorts blow up (they end up getting out, cutting losses quickly, leading to a massive SHORT-SQUEEZE). -Monaco

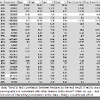

- on what DAY # (in my 7-day rolling period) do the best SQUEEZES typically occur on?

- on what day of the week do the best SQUEEZES typically occur on?

- for what market caps do the best squeezes happen on?

- with what catalysts?

- with what floats?

- with what Short % of float?

- was it a BIOTECH?

TRACKING STATS ------ Min 51:20----Min 1:12:45 ----- PART 4 ---- TRADING TECHNIQUES ....

- When tracking VOLUME, always track both of these:::::: [VOLUME in premarket] and [VOLUME end of day].......

- What was the stock's OPEN price?

- What was the stock's CLOSE price?

- What was the stock's HIGH TICK price?

- What was the stock's LOW TICK price?

a key when buying short-squeezes is to: buy right above WHOLE DOLLAR HALF DOLLAR LEVELS.... because this is then when the stock accelerates with upward momentum (when it is breaking significant psychological levels of resistance (per human nature and whim)).

a key when buying short-squeezes is to: buy right above WHOLE DOLLAR HALF DOLLAR LEVELS.... because this is then when the stock accelerates with upward momentum (when it is breaking significant psychological levels of resistance (per human nature and whim)).

UNDERSTANDING

SHORT-SQUEEZES (ON WEAK NEWS, OR NO NEWS)

If you watch the market

regularly, you may start to see stocks run without news. Or maybe it’s crappy

news but it spikes anyway. When is it safe to profit off this volatility?

Bottom line: The catalyst was trash. That’s why I didn’t touch it. I’m looking

for news that shows there’s value added to the company. Like new contracts or

business deals. An acquisition would be better than this... BUT WHY DO Why Did

It Spike? Don’t worry, there’s an easy explanation — it was a short

squeeze. Traders could tell that the stock was up on sketchy news. So they

decided to short the weak spike in the morning. But unfortunately, everyone had

the same idea. And when there are too many shorts on the same stock, a short

squeeze will push it higher. So what’s the deal here? Can we predict short

squeezes? Are they profitable?

Predicting Short

Squeezes

It’s not tough to

predict short squeezes. These days if you see a stock going parabolic

without news, it’s probably a short squeeze.

Some people try to look

at the short percentage of the stock to try and find squeezes beforehand. But

that data’s usually out of date.

I think that squeezes

are predictable but not reliable.

Profitable?

They certainly can be.

But because they’re so unreliable, I wouldn’t try it.

You never know how high

the stock will go. The catalyst is pure hype and panic. That’s a dangerous

combination.

Remember, these penny

stocks are junk anyway. Try not to buy junk with junk news.

My best advice is to sit

back and watch it all unfold. There’s a lot you can learn from squeezes, even

without trading them.

-

The

larger the volume bar located beneath the resistance price, the larger

short-sellers will size into their positions.... thus, the opposite is true:

when the stock breaks-out of a large resistance area, the

stronger/greater the break-out will be (#short-squeeze).. A short-squeeze has

about a 60% spiking potential; [to calculate the selling point on a

short-squeeze spike: stock price * .6 + stock

price = the perfect-scenario price i should sell all of my shares

into; it would be wise for me to sell prior and take profits into strength]. -Dux

-

A

short-squeeze typically results in a 60% spike!.. i.e. a stock will spike 60%

up (from

it's current price) when

a SHORT-SQUEEZE occurs... -[Dux commentary] <----------- for me to calculate the price i

should sell at on a short-squeeze spike (of approximately 60%), i must multiply the stock's

current price * 0.6, and then add that

number answer to the stock's current price TO GIVE ME

THE PRICE I SHOULD EXIT FROM MY TRADE (i must always take profits into

strength, meaning i need to sell before the stock reaches this

exit price to ensure i survive slippage and to ensure i have a buffer zone in

case the stock doesn't literally run 60% up... look to profit 30% -

40% of the stock's spike (instead of 60%). <--------- THIS KIND

OF MATH DOESN'T HAPPEN TRULY ALL OF THE TIME -- IT ONLY HAPPENS DURING A REALLY

HEAVY SHORT-SQUEEZE. -DUX

-

- the

larger the RESISTANCE VOLUME that the stock breaks out of, the higher the

short-squeeze will be. the larger the resistance area the stock

breaks out of, the stronger/greater the break-out will be (#short-squeeze).. A

short-squeeze has about a 60% spiking potential; [to calculate the selling

point on a short-squeeze spike: stock price * .6 + stock

price = the perfect-scenario price i should sell all of my shares

into; it would be wise for me to sell at maybe 25-40% and take profits into

strength].

-

Only

10% of people are short-sellers --- 90% of people are buying typically...... So

once longs start filling the Float, the shorts will get squeezed. However,

inversely, once the stock begins to drop, that will benefit the shorts. -[Dux

commentary]

-

-

VOLUME PREDICTION

-------- volume forecast is a way to predict end of day volume. The statistical

edge is not in the prediction itself but in how that prediction changes during

the day... Stocks that fill their prediction too quickly tend to short-squeeze,

and slow volume prediction tends to tank the stock.. Volume forecast is a

way of predicting volume in order to predict future price of a stock. For

example, trying to predict the end of day volume according to the first 30

minutes volume --------

https://inthemoneyadds.com/how-to-create-volume-forecast-model-backed-by-data/

.............. #VolumePrediction #Spikeet

-

PROMOTERS AND #PUMP AND

DUMPS AND #SHORT-#SQUEEZES

Pumpers know exactly

when to pump. They know that shorts panic at those key level.

When shorts feel trapped

and worry about a breakout, they cover their positions — which means buying

shares.

Pumpers start promoting

when the stock approaches these key levels. They know that if the shorts get

scared, the stock can go on a HUGE run (#short-squeezed).

You have traders

buying-in from the pump, and shorts buying-in to cover their positions. This is

why short squeezes can be so crazy.

The larger a stock’s

market cap and float, the harder it is to push the stock around.

That’s why almost every

chat pump is a low float stock.

Chatroom and Twitter

pumpers want to take advantage of supply and demand.

Pumpers use chatrooms or

Twitter feeds to create [fake demand] and bring in [volume]. They alert their

followers to their position and convince people the stock’s the next best

thing.

Then they sell into the

spike as buyers come in. Their goal is to profit from creating fake demand

which drives up a stock's price...

But if a stock has

plenty of supply(i.e. is a high float), a lot of demand and volume won’t move

the stock quickly.

-

Min 5 ---------

identifying MANIPULATION through VOLUME to PRICE ACTION symmetry and anomalies

--------- www.youtube.com/watch?v=vUhuoLIFjdA ............ !!!!!!!!!!!!!!!!

-

-

-

Friday mornings are special...........

#ShortSqueezes....... Fridays are the single most dangerous day to

short-sell........ but on Fridays, hype can take over and can create

short-squeezes, spiking big on Monday........... Friday short-squeezes can get

out of hand quickly......... If you really want to take advantage of the Friday

Morning Short squeezes, you look for the most active stocks (the biggest

percent winners), and you try to ride these morning spikes as they take out the

day high......... -Sykes

-

"What makes Friday different

than any other day..................... it's really the fact that

short-squeezes are more possible.. Stocks are more prone to squeeze as the

market is about to close." FRIDAYS ARE GREAT TO PLAY, IN AFTERNOONS (GREAT TO BUY STOCKS

AND THEN SELL IMMEDIATELY ON MONDAY MORNING).

-

I say it all the time …

The two best times to be aggressive as a day trader are Friday afternoons and

Monday mornings. On Friday, it’s all about squeezes. But on Mondays, it’s all

about capturing the new week’s momentum. If you wanna be the early bird that

gets the worm, you’ve gotta be prepared. ----------

www.youtube.com/watch?v=HDChGGfg2s4 .... #MustWatch

-

- remember that a low-float stock and/or heavily shorted stock --- can

squeeze further than you think, and crash even quicker (once the momentum

turns).

-

The importance of Volume #catalysts ---- More

volume enables bigger size, the trade will more likely work, shorts will be

squeezed... Whereas if there's no volume, you get these weird dump situations,

and if there's no buyers there at all, you're stuck... -Monaco

-

LOW VOLUME TRADING CAN

LEAD TO EPIC MOVES:::::::::::: with the market trading low volume like it has

been — we could see some epic moves. Why big moves when there’s little volume?

Traders who come to the market are looking for action. And when there’s not a

lot moving, and we get one nice chart pattern … Or an 8 a.m. press release… All

eyes will be on that stock. It’s like what happened with Palisade Bio, Inc.

(NASDAQ: PALI) on Tuesday. The markets were quiet, then we got one low floater

with news and a $3+ per share move! But you can also see some insane squeezes

on low volume. When there’s no volume for shorts to buy to cover into,

when they want to exit, their own buying starts to increase the price.

Then they all have to outbid each other to get out. Should you trade if you see

an opportunity today? Or avoid the market completely on a half-trading day?

That depends on your strategy and setup. If you see something you like, it’s

just like any other trading day. But if you’re okay with taking a day off -

that's okay too. -Bohen #volume #LowVolume #short-squeezes

-

Min 3

-------- VOLUME IS KING..... the news can be a positive reinforcement but Kyle

Williams focuses mostly on technical analysis and Volume (with news being a

third-rate variable) -------- trade the chart, trade the price

action #volume, (whether it has news or not, i don't care) -Kyle

Williams .... If the volume is there, that pretty much is what matters to me at

the end of the day (i can take bigger size; the trade's more likely to work;

short's will be squeezed)... -Monaco .... I've made the mistake of

falling in love with the great news but where the price action just did not

confirm it, so you kind of need both.. If you don't have the price action

to follow up with it (THE NEWS), then the trade won't do what you want it to so

i kind of always favor technicals over the news... -Kyle Williams ----------

www.youtube.com/watch?v=hQKGl05mcqg .......... The reason catalysts matter,

if but for any reason, is the volume it brings to the stock.. If the volume's

there that's pretty much what matters to me at the end of the day... -Monaco

-

‣ Predictable patterns. A

good catalyst can cause a surge of volume and a major short squeeze on

low-float stocks. It’s not a 100% reliable strategy but it does repeat. I often

say I’m a glorified history teacher … The sectors and companies change, but the

patterns stay the same.

-

#Buyout news can

potentially lead to a short-squeezing breakout opportunity if the stock doesn't

make it to it's buyout price:::::::::::::::::::::: "I don’t usually trade

stocks with buyout news... Usually, when a company announces buyout news, the

stock shoots up to the buyout price, then bounces around that level with no

volatility. Because the buyout offer essentially puts a fixed value on the

stock.. That’s why I don’t touch them — no volatility = no trade... But [this

stock] couldn’t even make it to the buyout price of $3 because shorts were

pushing it down. That leads me to think that this could be one of the dumbest

potential short squeezes I've ever seen. I’m not anticipating the move though.

I’m waiting for a key level… And that’s the $3 buyout price. If it gets over

that level, it rips faces off. See how you can ride the short-squeeze

momentum". -Bohen #buyouts #catalyst #news #short-squeezes

-

THE LOW

FLOAT SHORT-SQUEEZE

Low float stocks can have huge spikes and churn insane

volume. Shorts become convinced that these stocks have run too much.

But low floaters can run higher than you think...

If they continue rotating the float, they have a chance to run for multiple

days. Traders who understand this heading into 2022 could be well prepped for a

lot of opportunities.

-

FINDING PLAYS ----------

I care primarily about the Chart history... but I do care about the Float

(or shares outstanding).... that matters to me because: the fewer the

number of shares outstanding, the easier it is for the stock to squeeze

(spike)..... -Grittani

-

LOW

FLOATS DURING THE FIRST 2 HOURS OF THE DAY (are slow to spike)

The

best low float runners usually don't even run for the first 2 hours of the day

--- they gap up slightly and they just hold (they trap the shorts) -- this is

where shorts blow up (they end up getting out, cutting losses quickly, leading

to a massive short-squeeze). -Matt Monaco

-

COMMENT: ill take an entry at $3.13 if it can get

there; this thing has rotated its float so many times, its not good, tons of

shorts, that resistance break headed towards HOD could trigger a squeeze,

playing small if i do

QUESTION: can you please remind me why too much float

rotation is not good? (don't know)

ANSWER: it's just a rotation of new hands over and

over again, with more buying and shorting power. . . and the more these stocks

rotate, the more bag holders exchange bags (and run the stock down) with each

resistance, along with old shorts covering and new ones taking positions. . . .

. usually rotation is good for longs when they hold (taking shares out of

rotation and running the price up when there's demand), but over-rotation,

like 6 7 8 times over, isn't always the case.

ASKER: I figured that float rotation would be good.

ANSWER: well it is, but not excessively... so like a

float rotating in some cases like XELA in March was great because people held,

but the more bags exchanged, the more shorts adding on lower from the ones who

covered, it gets bearish. . . but you can flip it in cases to where its

extremely bullish too (where longs hold and are in control, and shorts keep getting

blown out and adding, and blown again, creates black swans type of squeezes). .

.

ASKER: Thanks for the explanation. It helps

*SYNOPSIS: [float

rotation is good for longs, but no too much float rotation (b/c bag holders

exchange bags and run the stock down), albeit, (where longs hold and are

in control, and shorts keep getting blown out and adding, and blown again,

creates black swans type of squeezes].

You don't know exactly what the shorts are doing, but i used to be a short-seller so i know the way they think. -Tim Sykes

When stocks spike and short-sellers are in the red (losing money),

that's what makes short squeezes so powerful — they’re a combination of intense

emotions. -Bohen

OTHER IMPORTANT TRADE

FACTORS TO ACKNOWLEDGE / RATE / HEED JUDGMENT UPON THE PLAY FOR OVERALL

Is the company a Recent

IPO? ---[if yes, that is a positive factor #potentiallyBullish]

Is it a Cool product /

service they sell? ---[if yes, that is a positive factor #potentiallyBullish]

Is it a chat pump? (are

chats pumping the stock? ---[if yes, that is a Pump-and-Dump sentiment

#TakeProfitsQuick #TradeAfter9:45AM]

Is it a well-timed Money

Monday press release ---[Monday PRs can lead to activity throughout the rest of

the week for the stock]

Is it a Quiet

morning/day in the markets? ---[[if yes, lots of eyes will potentially be on

stock, and shorts might be desperate for a trade #ShortSqueezePotential]

TRADING AFTER 9:45 AM

Before 9:45 am, it's

probably a great rule -- just don't trade that first 15-minutes of the day. The

first 15 minutes is just like, big spikes, fake dips, fake squeezes -- it's

tough. That's very difficult action to trade... After 9:45 am, you're going to

miss the crazy volatility, but it's going to keep you *safe*, and that's mostly

what it's about... Most traders, 90%, they lose money because they want in on

the action of the volatility. Prior to 9:45 am is almost like gambling. But if

you wait til 9:45 am, it's a rule to keep you safe. Because you can see great

trades post 9:45 am as well... -Monaco

My experience watching OFFERINGS has

been that the vast majority of the time a stock publicizes an OFFERING, the

stock takes a massive hit and tanks... However, i have seen instances where the

stock shrugs off dilution. Knowing the fundamental picture is important... I

will never use DILUTION or OFFERINGS to make

my trading decision (I still rely very much on technical analysis, b/c price

action and short-squeeze manipulation occurs purposely)... Technicals come

first, but fundamentals (dilution/offerings) can assist in decision making...

-Grittani [Min 40, TT2, Chapter 2]

WHAT IS A SHORT SQUEEZE

A short squeeze is when all the shorts who were betting against a

company are forced to exit. And when you exit a short position, it’s called

buying to cover. So, when all the shorts we’re betting on failure have to get

out they all buy at the same time and it spikes the stocks a lot.

Key Point: A Short Squeeze Can Spike Stocks Further ========= One reason

Tim doesn’t short much these days is because short selling is a very crowded

space. It’s filled with newbies and over-aggressive traders. When they get

caught on the wrong side, they panic buy to cover their positions. That spikes

the stock further.

The fundamentals don’t matter. It doesn’t matter what the fundamentals

are. When a company is running up on a short squeeze or momentum, the

fundamentals matter long term, but you cannot stay solvent in the long run if

you’re shorting too aggressively too soon.

Key Point: Shorting Is Very Dangerous for Newbies ========== There are a

lot of short-biased fake gurus out there ‘teaching’ newbies. The problem is,

most newbies fail to understand that fundamentals don’t matter in penny stocks.

They also don’t understand how fast a short squeeze can blow up an account. Tim

suggests you learn long patterns first and then work on shorting. If you really

want to short, take the time to learn the best setups. Paper trade at first.

But fundamentals don’t matter when a low-priced stock has momentum.

Fundamentals don’t matter when there’s a short squeeze. Trying to short

low-priced stocks is very difficult. The lower the price, the more difficult it

is.

What is a short squeeze?

* When a trade goes

against them, short sellers buy to cover for a loss. As more shorts cover it

can drive the stock price up. Longs then buy to take advantage of the spike. It

creates a frenzy of buyers called a short squeeze.

The Best Penny Stock Short Squeeze In 2020 ---------

https://www.youtube.com/watch?v=Dw6Y0N-30Io ...........

Short Squeeze: What It Is, Examples & How to Scan For It --------

https://www.timothysykes.com/blog/understanding-a-short-squeeze/ .......

-

Key Point: Short Sellers Are the New Promoters ======== Short selling is

a crowded game right now. Over-aggressive newbie short sellers are creating

massive short squeezes. At one point, Tim even referred to them as short

squeeze supernovas.

-

QUESTION: The last couple of days, we talked about short selling. But I

think it’s important to maybe raise some red flags, just give your opinions and

warnings on short selling. You call them the new promoters. So what does that

mean?

ANSWER: So lately short squeezes have pushed stocks up further than ever

before. There’s more short sellers because a lot of my top students have made

millions.* I’ve made millions short selling penny stocks* and it’s a nice

little niche strategy, but right now it’s a very crowded strategy.

So if you start shorting too soon, you can lose more than you put in.

And I just don’t think many newbies are aware of the potential for that great

risk. They’re not prepared to lose that much. It’s very dangerous. So I would

not really short sell, although I am short selling every now and then, but I’ve

also been trading for 20+ years.

QUESTION: How does more short sellers and more selling actually make the

stock squeeze and go higher?

ANSWER: the shorts all crowd each other out. It’s called a short

squeeze. Everyone’s thinking that a stock goes down, maybe there’s an absolute

scam, you think that it deserves to go down … probably it does deserve to go

down eventually.

But all the shorts crowding together, they squeeze each other. Because

for a short seller to get out of their short position — a negative position —

they have to buy to cover, which is no different than a buy.

If there’s news, they’re wrong and you have a group of 500 shorts all

being forced to buy to cover. Not only because of the stock price action, but

maybe their broker also can call back their shares.

So the stock might be fading perfectly, but then the broker calls in the

shares. Because to short, you’re taking out a loan from the brokerage. So they

can say, “Hey, we can’t loan out these shares anymore. We need you to buy to

cover.”

So you have 500 shorts all together buying at the same time after they

get their notice from their broker. Sometimes it happens at 3 p.m, sometimes

3:30 p.m. Eastern.

When that happens, the stock starts spiking.

So then sometimes you get the margin calls which creates a buying spike,

then you get some other shorts who see this spike and they know their friends

are getting squeezed out so they’re like, “Oh, I got to get out because the

stock is spiking.”

Then those of us who are momentum traders who love short squeezes, we

like buying just for a maximum pain for the short sellers. And then the stock

has three groups of people buying with very little selling. So that’s what can

create a short squeeze. And it’s much more powerful, much quicker than anything

else right now. So I’d be very careful to try to go against such a crazy

awesome force.

Key Point: You Can’t Know the Top or Bottom ======== A lot of short

sellers figure “it can’t go any higher” and even increase their position in a

stock … Only to see it spike even more. This stubbornness can increase the

spike of a short squeeze.

-

But as the stock squeezes higher, they’re forced to cover their shorts,

whether they’re naked shorts or real shorts. And that creates more buying

power, which is what propelled this stock up to the $5s, especially after

hours.

-

Overcrowded: Too Many Short Sellers Create Short Squeezes

It seems counterintuitive, right? How can a stock spike when there are

so many people selling? There are a few reasons…

• Brokers can call in shares: to short sell, you borrow shares from your

broker. The broker can call the shares back at any time. It’s called a buy-in,

and you don’t have control. What if the stock is up since you shorted and

you’re willing to hold? There’s nothing you can do. Brokers have the ability to

do a forced buy-in.

• Short selling is overcrowded: too many short sellers don’t have the

patience to wait for the backside of the move. They all want to nail the top.

So they get in too early, the stock keeps moving, and they decide to cut

losses. Just like when stop losses get taken out during a panic, shorts often

get squeezed at key levels. When they all buy to cover at the same time, the

stock spikes.

• Momentum buyers get in on the squeeze: short squeezes create upward

momentum. Longs jump on the momentum driving prices up more. Shorts get

squeezed more, and on it goes. This kind of price action can double or triple a

penny stock in a matter of hours.

-

You don’t have to stay in any trade. Ever. You have the power to exit

your position. That goes for longs trying to hold through a short squeeze, as

well. If a stock squeezes 100%, 200%, 300% … don’t chase. If you really love

trading short squeezes, trade scared. Trade small and take profits along the

way.

Why? Because the short sellers are right about all the reasons the stock

should go to zero. Eventually, there will be a big crack. You don’t want to be

long chasing a stock that drops 50% in a matter of minutes.

-

When you open the charts, look for…

What happened after the

squeeze?

Did the stock follow

the seven-step framework?

Was there a clear #4,

#5, and #6? (Review the seven-step framework if necessary.)

Has the stock run or spiked since then? If so, what was the catalyst?

(Do it. I know this kind of research is time consuming. It’s worth it. This is

how successful traders think.)

Remember, if you don’t study the past, the market will make you pay a

higher price for your education.

-

What’s the highest a short squeeze can spike a stock?

* It’s impossible to

guess. Which is why short selling is such a risky strategy in the current

market.

-

*****further reading --------------

https://www.timothysykes.com/blog/short-squeeze-supernova.................

-

Key Point: Weak Catalysts Can Create Opportunities, Too ========= Tim

shares that sometimes a weak catalyst can actually create opportunities. If it

makes short sellers rush in to take positions, it could lead to a short squeeze

— for Tim, this is a great chance to go long.

-

This is what a short squeeze looks like. $3.20 to $3.70 … this started

around 1 p.m. EST and this was 1:26, 1:27 p.m. So, 25 minutes.

This is not normally a very volatile stock. It actually finished

strongly, because I think again, some shorts are squeezed here. But it’s tough

to chase a stock on a third green day. And it’s tough to chase a short squeeze,

especially when the good news is already out. So, that’s a tough setup to

chase.

-

If a stock is up on nothing news, it normally wouldn’t be worth

watching. But in the current market, the epidemic of short sellers could create

a different kind of opportunity: a short squeeze.

When too many of these degenerates jump on board, it can create a short

squeeze and actually cause a spike.

So in certain cases, it might be worth looking at stocks with a weak

catalyst for your watchlist.

-

True or false: only REAL catalysts — those based on real, confirmed news

— make a stock watchlist-worthy.

* False. While a real

catalyst is great, a weak, hype-driven catalyst can also create opportunities

like short-term spikes and short squeezes.

-

FAILED SPIKES CAN EVENTUALLY TURN INTO BIG SPIKES (THROUGH SHORT

SQUEEZES)

Lately, a lot of failed spikers are actually turning around and becoming

spikers because short sellers get too aggressive.

Short sellers' aggression can turn against them. That can make what

should be a failed stock into an insane spiker.

-

True or false: Short sellers can get squeezed in speculative

trades.

* True. Speculative

trades tend to attract short sellers. Their aggressive approach can create

short squeezes.

-

When a stock spikes like UAVS did, it starts to attract a ton of

traders.

Short sellers start getting in, but there are too many, which creates a

short squeeze. This drives the price up even further.

Then you have the big crash from $5 down to $1, and it actually becomes

a good dip buy.

You could say it’s like a #4 to #5 pattern if you’re using my seven-step

framework. But the whole run-up from the $1s to the $5s was momentum buyers,

hot sector, hot market, and short squeeze.

This is a cycle we’re seeing play out again and again in the market

right now. If you’re one of the few traders who can see it, you can be in a

much better position to take advantage of it the next time it happens.

THE RECIPE FOR A SHORT-SQUEEZE: no one is selling shares (shown on level 2) ... thus, you have short's getting squeezed ... you have buy-ins ... you have lack of a volume ... and you have uptrending price action..... -Tim Sykes

Fridays are SHORT-SQUEEZE DAYS......... -Sykes

Typically, short-sellers do not want to hold over the weekend (short-squeeze spike-potential toward the end of the day on Fridays). . . -Matt Monaco

How stock splits result into short-squeezes -------- www.youtube.com/watch?v=ZhtUIC9N9b4 ......... #stockSplit #short-squeezes #shortSqueeze #reverseStockSplit

First 4 minutes --------

explaining how a SHORT-SQUEEZE can be identified = you have FAKE HIGH OF DAY

BREAKOUTS, WITH LARGE WICKS, AND THE STOCK THEN HOLDING SUPPORT (LEADING TO

SHORTS GETTING SQUEEZED OUT AND LONGS PILING ON) -----------

www.youtube.com/watch?v=l2UlMFQb4wo .............. #ShortSqueeze

-

First 5 minutes ----------

stocks that are EASY TO BORROW lead to short-squeeze opportunities, especially

on DAY 1 spikes (you should never short on Day 1) ------- it is short-sellers

that are propping a short-squeeze upwards (not longs) ----------

www.youtube.com/watch?v=AhHxQEX_Qpk .........

-

What’s a short squeeze and

why does it happen?

Short sellers borrow shares

in a stock when they think the stock’s headed down. They profit by buying the

shares at a lower price. (It’s like going long, just in reverse.) To manage

risk, shorts have to exit positions when the share price goes up.

Otherwise, they can lose

big...

Traders try to take

advantage of heavily shorted stocks by forcing shorts out of their positions.

Again, the shorts have to buy the shares to close their positions. And all that

buying sends the stock price even higher.

That’s when we get those

awesome parabolic moves. Learn more about short squeezes here.

Now, heavily shorted stocks

don’t always make for good squeeze opportunities … If a stock keeps falling,

shorts aren’t as likely to close their positions.

-

Min 4 --------- it's the

short-sellers that allow the stock to spike so much ---------

www.youtube.com/watch?v=2oudRGkloZY ........... #Sykes #ShortSqueeze

-

Many of these traders are running their scans and finding big percent gainers

with high short interests. The more dubious, the more likely they think it is

to squeeze them “to the moon.”

These kinds of squeezes are happening more often and for longer periods of

time. Two days used to be considered a long squeeze, but now we’re seeing

multiday, multi-month squeezes … That can mean plenty of opportunities along

the way.

But remember that this won’t last forever. Eventually the reckoning will come,

and squeezed stocks will crash again. It’s inevitable.

Learn from this action. And before you make a trade, always have a risk

management plan. Set clear entries, exits, and risk levels. Keep your

expectations and goals realistic.

-

ANSWER: Shorts had success

years ago with this strategy when hanging out below VWAP was a bearish trend.

Now, traders use this knowledge to squeeze the shorts. Look at BBIG yesterday …

It fell below VWAP, built some momentum, and exploded for a 14% gain once it

found solid support. Will shorts ever learn? I don’t know. For now, it seems

traders will continue to see BIG opportunities like BBIG.

-

Penny stocks don’t move

in sympathy with the overall markets. They move on BS press releases, short

squeezes, and breaks through technical levels. -Bohen

-

MARKET ENVIRONMENT

EVOLUTION

From 2007 - 2015 was

that golden age of SHORT-SELLING.

Late 2015 - Late 2016

was the epic age of low float SHORT-SQUEEZES [...in the post-2016 world

shorting is an overcrowded strategy. Stocks don’t pull back like they used to.

Instead, they consolidate sideways]. -Bohen

-

Min 28:30 ------- Min 31 ----------

Min 57 ----------- on how shorting works #cryptoShorting-_- ---------- $2.50

rule --------- www.youtube.com/watch?v=l7w2IhPX5PY ..... #shorting #sykes #short-squeezes

-

TRADING PSYCHOLOGY (playbook)

• If a stock holds close to the high over a long period of time (3+ days), that weakens its hold (it is more likely to be OVER-EXTENDED and drop in price). <------good for SHORTS

• If a stock tanks (like many #biotechs on DAY 1), it will take a lot of buyers (volume) to break through resistance. <------heavy VOLUME is needed (for it to spike) if it's far from its HIGHS

Before you take a trade, ask yourself, "how scared would i be if i were a short-seller in this position"?... Put yourself in their shoes to get a sense of what you might expect. -Bohen -

WHEN THE BEST TIME A

SHORT-SQUEEZE IS LIKELY TO HAPPEN

Imagine if you tried to

short a stock against it's highs on that FIRST HEAVY VOLUME DAY (First Green

Day). Without the stock making a significant push lower, holding those shorts

becomes harder and harder. <--------★bad for SHORTS (i.e. SHORT-SQUEEZE POTENTIAL)

On the flip side, if a

stock falls away from the highs and stays low, like many #BIOTECHS do on Day 1,

it will take a lot of buyers (and volume) to break through that resistance

area. <---------★heavy VOLUME is needed

(for a stock to spike) if it is far from its HIGHS.

▶ Before you take any

trade after 9:45 am, ask yourself, "how scared would I be if i were a

*Short-seller* in this position?" .... Put yourself in their shoes to get

a sense of what you might expect.

-

Friday's--- stocks can spike because the news can

spread over the weekend......................Stocks tend to spike on

Fridays going into the close......because shorters don't want to have shorts

over the weekend....... veteran traders buy the momentum on Fridays..newbies

buy on Mondays...it creates a great probability for BUYING STOCKS ON A FRIDAY

AFTERNOON AND SELLING THEM ON MONDAY..... stocks are more prone to squeeze as

the market is about to close.

-

BUY LONG AND SHORT-SELL-------Be able to go long and short.. That's why

you need a margin account.. this is required.... I know some of you

guys don't want to short.....that's like having only a forehand in

tennis......To be a great tennis player you need a forehand and backhand...

even if you don't necessarily want to short, at least learn how shorts think,

so that when a stock short-squeezes, you can benefit and buy the stock

rising... -Tim Sykes

-

"What makes Friday different

than any other day..................... it's really the fact that short-squeezes

are more possible.. Stocks are more prone to squeeze as the market is about to

close." FRIDAYS

ARE GREAT TO PLAY, IN AFTERNOONS (GREAT TO BUY STOCKS AND THEN SELL IMMEDIATELY

ON MONDAY MORNING)

-

STRATEGY---- Rule: Don't buy breakouts mid-day (12 pm - 1

pm).... I sometimes buy 2 - 3:30 pm because it can squeeze. -Tim Sykes

-

SHORT-SQUEEZE ---- this is when a lot of people betting on lower prices,

get squeezed OUT OF THEIR POSITIONS. . . you can lose more than you have in

your account when it comes to shorting. . . let's say you have $50k in your

account, and the stock is going against you, now you're down $50k --- the

broker will issue a margin call, and they'll say "hey you need to put up

more cash, or we will liquidate your position". . . let's say you have no

more cash. . . . the brokerage buys you in at your short position at $70. . .

and they're also buying other short-sellers. . and other brokers are

covering other short-sellers --- so what happens is all these brokers are

buying the cover at the same time and that can lead to even higher prices which

can be a SHORT SQUEEZE. . . . . short-squeezes can keep going for hours and

days and weeks until all of the short-sellers are bought in willingly or by

their broker. . . . .

-

Always

doubt the reason why a penny stock is spiking..... it's either the momentum

crowd has a hold of it, maybe some short-sellers got squeezed early, or someone

on the inside is hyping/promoting the company so insiders can sell

shares........ It's the same formula: Get the low-priced stock up and that way

insiders can sell into the stock.......... I TRADE WITH A VERY VERY VERY SMALL

ACCOUNT IN ORDER TO SHOW YOU HOW TO PIGGY BACK THESE RUN-UPS.......

-

You have to understand that, within 3-days of your short,

if it's a hard to borrow stock, no matter what broker you use, you might get

bought in at your position at an inopportune time..... when you cover a short,

they buy the stock, the stock goes up (short-squeeze)........ So if you think

the stock is going to drop within 3-days, short. . . . . but if you think that

maybe it's going to take 7-days, and there's a good chance of you being bought

in during the interim, then it's risky..........

-

Strategy----Breaking out due to panicking shorts/margin calls/forced

buying (Squeeze Breakout)--------------- I will be QUICK to buy-to-cover here

as well...... Short-sellers, they don't necessarily want to buy the

stock, but they're getting squeezed - they have to buy their losses. Stocks get

squeezed... And they can actually go up faster... But then the squeeze (stock

going up) can also retrace (and can down-trend just as quickly).

-

A morning spike (gap up) --- shorts are getting squeezed...... then it

takes a few days and it crashes down..... -tim sykes

-

It's possible this strategy (for penny stocks) is applicable to other

niches.............. i don't know..... i'm sure if you look for parabolic moves

(like supernovas) in other niches, i'm sure it will work......... Stocks have

supernovas based on a short-squeeze (not because the company

did anything great), and then the stock dropped 40% off it's highs....

-

Insight | Wisdom------Do not memorize these patterns.....

they mutate.......patterns can evolve and change........ If my DVDs strategies

get popular enough,, these patterns will flip........shorting on

the first red day will actually be a great buying opportunity because all of

the idiot shorts who watch these DVDs and don't learn that patterns evolve,

will be short and you can squeeze them.. and i'll be making

pennystocking part 16 (and it'll be like, "you actually have to buy on the

first red day")....... i can't destroy these patterns or create them, but

i will help them evolve...... Understand variables so you can adapt........

-

Buying an afternoon breakout is not as good as

buying a morning breakout (typically in the morning, it's spiking based on

emotional buyers creating momentum); but typically in the afternoon, most

people are emotional with the potential short-squeeze happening so there is

more hesitancy. For the afternoon breakout i size in a little bit smaller

than I do for the morning breakout.. -Dux

-

A short-squeeze typically results in a 60% spike!..

i.e. a stock will spike 60% up (from it's current

price) when a SHORT-SQUEEZE occurs... -[Dux

commentary] <----------- for me to calculate the price i

should sell at on a short-squeeze spike (of approximately 60%), i must multiply the stock's

current price * 0.6, and then add that

number answer to the stock's current price TO GIVE ME

THE PRICE I SHOULD EXIT FROM MY TRADE (i must always take profits into

strength, meaning i need to sell before the stock reaches this

exit price to ensure i survive slippage and to ensure i have a buffer zone in

case the stock doesn't literally run 60% up... look to profit 30% -

40% of the stock's spike (instead of 60%). <---------

THIS KIND OF MATH DOESN'T HAPPEN TRULY ALL OF THE TIME -- IT ONLY HAPPENS

DURING A REALLY HEAVY SHORT-SQUEEZE. -DUX

-

Min 3:38:00 of Part

2 ORIGINAL vid ------- how to short after a

short-squeeze happens ------ www.stevenduxi.com/trading-techniques-video-course/

............

-

The larger the volume bar located beneath the

resistance price, the larger short-sellers will size into their positions....

thus, the opposite is true: when the stock breaks-out of a

large resistance area, the stronger/greater the break-out will be

(#short-squeeze).. A short-squeeze has about a 60% spiking potential; [to

calculate the selling point on a short-squeeze spike: stock price * .6 + stock

price = the perfect-scenario price i should sell all of my shares

into; it would be wise for me to sell prior and take profits into strength]. -Dux

-

- the larger the RESISTANCE VOLUME that the stock

breaks out of, the higher the short-squeeze will be. the larger the

resistance area the stock breaks out of, the stronger/greater the break-out

will be (#short-squeeze).. A short-squeeze has about a 60% spiking potential;

[to calculate the selling point on a short-squeeze spike: stock price * .6 + stock

price = the perfect-scenario price i should sell all of my shares

into; it would be wise for me to sell at maybe 25-40% and take profits into

strength].

-

Shorting into resistance for this pattern will

give you an even greater percentage than shorting without any resistance. ...

because it is a parabolic, you do not know where the top is -- that's what

makes this pattern so dangerous... Once you have a larger account size, then go

for trading this pattern (since you can afford to risk losing capital)... I do not

recommend shorting into parabolics without any heavy resistance before in it's

past history of the chart [Min 1:55:00, PART 2]. Especially

do not short into a parabolic without past heavy resistance (i.e.

heavy volume at that resistance level) IF IT IS A LOW FLOAT STOCK (lest

you get squeezed) -_- .. to

find the correct resistance level, you have to be looking at the long-term

chart (most of the time, you want to pick the chart's previous resistance as

your risk level; only if the resistance's volume level at that time was over

20+M, otherwise it is not considered very strong resistance (not strong enough

to short into confidently) --- otherwise then i choose a consolidating area to

risk my short-selling trade off of..... -Dux

-

Min

1:08:00 -----------

do not short-sell into parabolics until you can find a clear risk-level | if

the stock is consolidating GET THE HELL OUT because the stock can pull some

crazy short-squeeze spike | if the stock is fading THAT'S FINE --------- Trading

Techniques Part 2 [www.stevenduxi.com/trading-techniques-video-course/]....... #Dux!!!!!!!!!!!!

-

DO NOT USE THE BOUNCE SHORT STRATEGY ON A STOCK IF

THE VOLUME IS UNDER 10 MILLION! BECAUSE THAT'S NOT A VERY GOOD RESISTANCE LEVEL

TO RISK OFF OF (WHEN SHORTING), AND IT'S VERY LIKELY TO BREAK THAT RESISTANCE

LEVEL (AND SPIKE UP / SHORT-SQUEEZE), ESPECIALLY ON LOW MARKET CAP AND LOW

FLOAT STOCKS! .... On the other hand, 50million resistance is unbreakable

(great to short-into), so the stock will likely not break that resistance

level, but if it does then Dux says he just cuts his losses (b/c the winning %

is so high, he is comfortable with losing 10%-15% of his original

investments)... Volume at 2 million is very light resistance (not good to

short-into as a short-seller)... Typically, i won't be using the BOUNCE SHORT

pattern to short a stock if the volume(resistance) is under 10million... -Dux

-

*****for the FIRST RED DAY you do not have to be in a rush b/c the stock is

already over-extended, so if you rush the stock might have a short-squeeze...

so wait (the entire day) until the stock shows weakness first (to see

if the stock is running out of strength)... if the stock starts fading and

closes weak at the end of the day (no matter if the stock is still green or red

on the day; so long as it has 1. a failed morning spike AND 2. is closing very

very weak).... As long as the stock is really over-extended, it can drop by

70%-90% from it's highs... However if the stock just went from $1-$10, or

$1-$15 or $1-$20 -- it typically drops about HALF of it's parabolic spike

(where you can make 20%-30% profit from it by short-selling it before it

reaches hitting that 1/2HALF of it's own spike (you would be shorting it

at the end of the day (taking 1/4 your position) during the end of the first

red day; then if the stock starts to spike a little bit in the morning, I would

add another 1/2(half) to my short position; if it continues going up add

another 1/4... if it hits your major resistance level ADD ANOTHER 1/2(half) of

your position... that's basically how (dux) manages his risk for the FIRST RED

DAY...) with shorting, you have to be able to afford to lose

before entering your positions fully (losing on at least one third of your

sizing in, if not losing on 4/4ths of your sizing in, before you can expect to

profit | if you can't afford to lose then that'll bring an emotional factor to

your trading causing you to lose more money).... -[Dux commentary]

-

Once the

over-extended gap down fails and starts taking out the day high (and starts

going green), it will create a massive short-squeeze... -Dux

-

The

maximum short-squeeze percentage (spike) is about 60% - 70% before it starts

consolidating... –Dux ß----YO I NEED TO TRACK THIS!

-

TRACKING THE MAXIMUM SHORT-SQUEEZE

PERCENTAGE OF A STOCK ------- Min 00:21:00 AND Min

1:36:30 AND Min 2:56:20 of Part 4.

-

Only 10% of people are short-sellers --- 90% of

people are buying typically (b/c they don't know how to short-sell)...... So

once longs start filling the Float, the shorts will get squeezed..... But if

the stock drops first then all of the longs become

bagholders.... . -[Dux commentary]

-

Spikeability

dvd – part 2 --- Min1:37:00 — on SHORT SQUEEZES

-

-

-

With the parabolic short-selling strategy, you take a short position based on

the thesis that the stock will keep going higher. Confusing, right? But the

idea behind it is that you're shorting it with a plan to add higher.

Essentially, you’re scaling into a short position.

So when a stock starts to spike, you might short 100 shares at around $3.50.

Then you might add 100 shares at $4, and more at $4.50…

Because the more parabolic — meaning straight up — a stock goes, the more

shorts think it will pull back really hard and they can buy to cover to get

out.

The problem with that is, in the post-2016 world shorting is an overcrowded

strategy. Stocks don’t pull back like they used to. Instead, they consolidate

sideways.

And shorts add into any pops.

Then when the stock opens red the next day, they think they’ve got the trade in

the bag. And they start hammering it even harder…

Now, the shorts are in full size. They’ve maxed out their buying power and

margin…

Then the stock has an uptick. And they get nervous…

Then it breaks above the opening price. So they up their risk to the

red-to-green level…

…Now the stock goes from red to green.

Suddenly more shorts are nervous and they have to buy to cover to get

out.

That creates a wave of buying where it’s shorts hitting market orders and

outbidding each other to get out.

And that’s why most short squeezes happen in the afternoon.

Because the longer shorts have to watch a stock consolidate, grind back, and

then continue to make new highs, the more nervous they become…

Then they finally have to accept they’re wrong and exit the trade. And if they

don’t, their broker will do a margin call and force them out.

That’s what makes afternoon moves so powerful.. -Bohen #shorting

#parabolicShort #Squeezes #afternoonVWAPHolds #short-Squeezes

SHORT-SQUEEZE ---- this is when a lot of people betting on lower prices, get

squeezed OUT OF THEIR POSITIONS. . . you can lose more than you have in your

account when it comes to shorting. . . let's say you have $50k in your account,

and the stock is going against you, now you're down $50k --- the broker will

issue a margin call, and they'll say "hey you need to put up more cash, or

we will liquidate your position". . . let's say you have no more cash. . .

. the brokerage buys you in at your short position at $70. . . and they're also

buying other short-sellers. . and other brokers are covering other

short-sellers --- so what happens is all these brokers are buying the cover at

the same time and that can lead to even higher prices which can be a SHORT

SQUEEZE. . . . . short-squeezes can keep going for hours and days and weeks

until all of the short-sellers are bought in willingly or by their broker. . .

. .

The

shares that are available to short ------ the HIGHER the potential for the

short squeeze............. #ShortSqueezeWARNING............. the biggest

spikers are almost always the low-float, hard to borrow stocks.......... -bohen

You don't want to under-estimate the power of a SHORT SQUEEZE. . .

a company that could be worth $0, it can still rise faster and further than you

ever anticipated, and I've seen this. . . . one stock went from $5

to $120 -- so be very careful every time you're short-selling. ..

there can always be a short-squeeze that can lead to your ruin. . . . -TIM

SYKES

SHORT-SELLING

----- you're taking out a loan from your brokerage.... you sell shares you

don't own..... If the stock price decreases in value, your "negative"

position (* times *) a negative dropping in the price = a positive ($). . . . .

. . . . . . . . . . . . . [a negative (times) a negative = a position]. . . .

The biggest risk is what if you're wrong. . . If the stock goes from $20 to

$100, now your negative 1000 shares at $100, your $20,000 is $80 lost per share,

which means you lost 4x as much as you put in. . . . . so for short-selling,

you can lose much more cause the stock can go up infinitely. . . In a BULL

MARKET, shorting is very dangerous. . . . Short-squeezes are no joke. . . -TIM

SYKES

#3 Short Squeeze: A short squeeze is a phenomenon when investors

trigger a rise in price on a heavily shorted stock. Investors trigger a short

squeeze by extensively closing short positions and creating high buying volume.

The reason behind this is usually their common belief that a stock will become

unprofitable. The opposite of the short squeeze is the less common long

squeeze, which will lead to further decline in a security’s price.

STRATEGY--- When there's no morning spike left,

that means most of the shorts are out, or amateur short sellers have been

squeezed out..... and then the fade starts to take effect......... -sykes

!!!!!!!~~SHORTING ON FRIDAYS, Be scared shorting on Fridays, especially in

the afternoon........watch out for Friday short squeezes..

SHORT-SELLING OVER THE WEEKEND------I don't want to be short over

the weekend. Yes, while the stock is eventually going to crash, it could

squeeze you in the meantime, and you could have massive massive losses in the

meantime. you can buy the breakout instead..... i love the fact that this

short-squeeze (trends upward)-- i want it to go higher! early shorts and

wannabe shorts, when the stock doesn't go down, and if your broker calls in the

loan, then you have to buy to cover,,, that creates a short-squeeze. The question

is when will the short-squeeze be over.. -Tim Sykes

~~Even if you don't want to short-sell, learn how shorts view the

market so you can buy into short squeezes!

Shorting EARNINGS WINNERS will

get you into trouble........... because you're gonna short, and the stock will

keep going up, and you'll add to your shorts and then get

squeezed.... Earnings winners can spike on Day 2 or Day 3, and sometimes

earnings winners can spike big on Day 5 or Day 7.... -tim sykes

Min 4:57 ------ How to short penny stocks in a squeeze market (intraday

trading scalp only, wait for day 2 & 3)-----

www.youtube.com/watch?v=b3qGKhHMCIM .......

Lose the small battles but win the war.... if i short a stock and it

shoots up and i lose, that short squeeze will then open up more shares to short

when the stock peaks, resulting in it's then inevitable crash whereby I'd then

purchase even more shares to short , and when the stock crashes, I'll make

exponentially more than the loss i incurred earlier.... i lose a small battle

but win the war at large...... -[tim sykes summarized explanation]

A company turns into an SSR when it hits

certain levels, especially if it's down 10% from the previous day. It makes it

very difficult to short, and short-sellers then turn into long buyers because

they know of the potential of a short-squeeze.

So, the short sale restriction can sometimes go

hand in hand with parabolic moves and really quick short squeezes to the upside

because the ability to go short is made difficult (due to one needing to buy

shares to short on upticks which is risky/tough).

When a stock takes many days to go up, it will also take many days for

the stock to drop (..Dux explains his holding a short position on CEI (circa

the beginning of October 2021)... When the stock begins to drop it forms

consolidation; once it cracks under consolidation you can re-short and build

your avg into the consolidation resistance (by pulling your average entry price

down to the consolidation level price area; and this is where your entry

becomes your "risk" level for selling should the stock spike

up/short-squeeze you)... -[Dux commentary]

When there's $2 of upside and .30 or .40 cents of downside, I want to

bet big! ....... (hopefully it's not too tough to get executed).... The best shorts

can become the best short-squeezes...

Min 28 ------- sector momentum is real and must be respected (by

short-sellers, lest they get squeezed out)........... Brian Lee [Beyond the PDT] ----------

www.youtube.com/watch?v=mDUnrcKDFkk ...........

Typically short-sellers do not want to hold

over the weekend (short-squeeze spike potentials toward the end of the day on

Fridays). . . -Matt Monaco

Min 9 ------- a great technical analysis

illustration of SHORT SQUEEZE SETUPS -------- www.youtube.com/watch?app=desktop&v=ip2uVzQWGTc

.......

Friday mornings are special........

#ShortSqueezes....... Fridays are the single most dangerous day to

short-sell........ but on Fridays, hype can take over and can create

short-squeezes, spiking big on Monday........... Friday short squeezes can get

out of hand quickly......... If you really want to take advantage of the Friday

Morning Short squeezes, you look for the most active stocks (the biggest

percent winners), and you try to ride these morning spikes as they take out the

day high......... -Sykes

Short squeezes (spikes), will inevitably lead to crashes eventually...

-Sykes

Min 9 ------- a great technical analysis illustration of SHORT SQUEEZE

SETUPS -------- www.youtube.com/watch?app=desktop&v=ip2uVzQWGTc

.............. #shorting

It is very difficult for a stock to sustain a short-squeeze for three if

not four days..... it will drop sooner rather than later (there's only so many

shorts who can be squeezed)....... –Sykes

If you understand short-selling, and how early-shorts can get squeezed,

that makes it better for shorting later, as early shorts had already

panicked... -[Sykes commentary]

Friday mornings are special........... #ShortSqueezes....... Fridays are

the single most dangerous day to short-sell........ but on Fridays, hype can

take over and can create short-squeezes, spiking big on Monday...........

Friday short squeezes can get out of hand quickly......... If you really want

to take advantage of the Friday Morning Short squeezes, you look for the most

active stocks (the biggest percent winners), and you try to ride these morning

spikes as they take out the day high......... -Sykes

THE TREND OF 2021

QUESTION: The beginning

of most meaningful short squeezes occurs below VWAP. Can someone point out why?

Min 28 ------- sector momentum is real and must

be respected (by short-sellers, lest they get squeezed out).........Brian Lee

[Beyond the PDT] ------- www.youtube.com/watch?v=mDUnrcKDFkk .........

These sketchy biotech stocks ... are always heavily shorted. -[Bohen commentary] #biotechs #short-squeezePotential

Min 1 ------------ Min 7 ----------------- the dangers of shorting are #short-squeezes | when to short after the squueze happens! | use tradezero to short in 2023 ----------- www.youtube.com/watch?v=UV3MQ4UCXtA ............. #shortingIsRisky

Min 13 — on promoters and short-squeezes — https://m.youtube.com/watch?v=qwNJXmJ44xg ........ #shortSqueeze #promoters

HOW THE PARABOLIC SHORT-SELLING STRATEGY LEADS

TO SHORT-SQUEEZES

Min 3:30 --------- Min 8:30 --------- on forced buy-ins creating short squeezes by brokers ------- www.youtube.com/watch?v=M4UAuCO4Am4 ......... #shorting #buy-ins #sykes #short-squeeze

Min 28:30 ------- Min 31 ---------- Min 57 ----------- on how shorting works #cryptoShorting-_- ---------- $2.50 rule --------- www.youtube.com/watch?v=l7w2IhPX5PY ..... #shorting #sykes #short-squeezes

When early short-sellers get squeezed, that makes it a better short-selling opportunity later..............

Min 28 ------- sector momentum is real and must be respected (by short-sellers, lest they get squeezed out).........Brian Lee [Beyond the PDT] ------- www.youtube.com/watch?v=mDUnrcKDFkk .........

There's no accurate short-selling data. Most of

the data is one or two months delayed, and even when you see the "short

interest" [i.e. short float / shares short / short % of float / short

percentage] from a month or two ago, it's not usually accurate... The good news

is, short-sellers are like angry vegans, and they like to tell everybody that

they're short, so you can use social media/STT Breaking News, they alert the

best pumps and the biggest short-squeezes...-Sykes #SHORT-SQUEEZES

Min 17:30 ---------- a high "short float" % is very dangerous to short, because that means shorts need a way to get out; if a stock has a high SHORT FLOAT then the edge is to the long-side #shortSqueeze (ANYTHING OVER 40%) -------- www.youtube.com/watch?v=eNgIv-bVcn4 ......... #shorting

Min 4:20 - Min 6:10 ---------- Identifying short-squeeze plays::::::: 1) when a stock holds SUPPORT, and continues HOLDING major SUPPORT Levels, that is a BULLISH sign --------- www.youtube.com/watch?v=BDfv10zYf-I ....... #short-squeezes #sympathyPlaysSpikeAtSameTimeAndGoDownAtSameTime #dipbuys #dipbuying

When trading BIG CAP STOCKS --- Find out what the SHORT RATIO is of a stock.. If the entire float is being shorted, then it's likely to create a massive squeeze...

Min 31:20 -------- how short-squeezes are started ------- www.youtube.com/watch?v=riEVth7L1uA&t=1260s ……….. #sykes #huddie

PROMOTERS AND #PUMP AND

DUMPS AND #SHORT-#SQUEEZES

Pumpers know exactly

when to pump. They know that shorts panic at those key level.

When shorts feel trapped

and worry about a breakout, they cover their positions — which means buying

shares.

Pumpers start promoting

when the stock approaches these key levels. They know that if the shorts get

scared, the stock can go on a HUGE run (#short-squeezed).

You have traders

buying-in from the pump, and shorts buying-in to cover their positions. This is

why short squeezes can be so crazy.

The larger a stock’s

market cap and float, the harder it is to push the stock around.

That’s why almost every

chat pump is a low float stock.

Chatroom and Twitter

pumpers want to take advantage of supply and demand.

Pumpers use chatrooms or

Twitter feeds to create [fake demand] and bring in [volume]. They alert their

followers to their position and convince people the stock’s the next best

thing.

Then they sell into the

spike as buyers come in. Their goal is to profit from creating fake demand

which drives up a stock's price...

But if a stock has

plenty of supply (i.e. is a high float), a lot of demand and volume won’t move

the stock quickly.

#SHORT-SQUEEZES (ON WEAK

NEWS, OR NO NEWS)

If you watch the market

regularly, you may start to see stocks run without news. Or maybe its crappy

news but it spikes anyway. When is it safe to profit off this volatility?

Bottom line: The catalyst was trash. That’s why I didn’t touch it. I’m looking

for news that shows there’s value added to the company. Like new contracts or

business deals. An acquisition would be better than this... BUT WHY DO Why Did

It Spike? Don’t worry, there’s an easy explanation — it was a short squeeze.

Traders could tell that the stock was up on sketchy news. So they decided to

short the weak spike in the morning. But unfortunately, everyone had the same

idea. And when there are too many shorts on the same stock, a short squeeze

will push it higher. So what’s the deal here? Can we predict short squeezes?

Are they profitable?

-

Predicting Short Squeezes

It’s not tough to predict

short squeezes. These days if you see a stock going parabolic without news,

it’s probably a short squeeze.

Some people try to look at

the short percentage of the stock to try and find squeezes beforehand. But that

data’s usually out of date.

I think that squeezes are

predictable but not reliable.

Profitable?

They certainly can be. But

because they’re so unreliable, I wouldn’t try it.

You never know how high the

stock will go. The catalyst is pure hype and panic. That’s a dangerous

combination.

Remember, these penny

stocks are junk anyway. Try not to buy junk with junk news.

My best advice is to sit

back and watch it all unfold. There’s a lot you can learn from squeezes, even

without trading them.

Min 21:30 -------

Jackaroo dropping gems on WATCHLISTING stocks that keep running up over a

month’s time with short’s piling in --------

www.youtube.com/watch?v=w_yqoTJgrt8 ........

Failed bearish patterns are

great bullish patterns... If something looks like it shouldn't work, and it

does -- it's probably got shorts caught in it (great ShortSqueeze

opportunity)... However, if it looks too extended (the spike) it probably needs

to rest a bit #consolidate... -Tuohey

COMMENT: As Matt Monaco

once said, the key to going long is knowing where shorts are f@%#ed

QUESTION: How do you know

where shorts are F%#K$?

COMMENT: imagine being

short. where would u enter, where would u been in PAIN?

COMMENT: Daily charts,

shorts will attack one and done's more. Also lots of these companies mostly gap

up with the purpose to dilute to raise cash.

WISDOM---------You see the first morning spike, and then the second one........This is how the stock created it's huge gains...........I'm not crazy in saying that the short-sellers are responsible for these huge spikes.... of course the short-sellers are responsible..... Who's going to buy a stock that goes from $5 to $50..........??? It's shorts covering...... -Sykes <------THE REASON WHY STOCKS SPIKE (AT TIMES)

A morning spike (gap up) --- shorts are getting squeezed...... then it takes a few days and it crashes down..... -tim sykes

You have the volume spike, you have the stock spike (break-out),,, you have to buy it... you have to take advantage of the short's covering (and pushing the stock up higher)....... -tim sykes

It's possible this strategy (for penny stocks) is applicable to other niches.............. i don't know..... i'm sure if you look for parabolic moves (like supernovas) in other niches, i'm sure it will work......... Stocks have supernovas based on a short-squeeze (not because the company did anything great), and then the stock dropped 40% off it's highs....

The idea is I find a stock that’s shot up on news and then held near the highs.

That effectively ‘traps’ short sellers near their stops.

If a stock manages to drop, they get an opportunity to exit at a profit.

But when the stock holds near the highs, it makes them nervous with an itchy trigger finger.

And most of them put their stops right at the recent highs. -Bohen