TRACKING STATS ------ Min 51:20----Min 1:12:45 ----- PART 4 ---- TRADING TECHNIQUES ....

The biggest problem with trading biotechs is that most traders don’t know about them until it’s too late…

They see a stock that’s up 100% or more, then jump in without a plan or knowing why the stock’s even up.

Or worse, they don’t see the stock until the next day. Then they try to DIP BUY it when the move’s already over.

Let me be clear: Biotech stocks are not DIP BUYS.

To catch big biotech runners, your best odds are to catch the first-day move. When biotech companies announce news, that can bring in high volume and hype... -Bohen #biotechs #breakouts #dipbuys #chasing #fomo

_________________________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________________________________

OVER THE COUNTER | #OTCBBs | #OTCQB | #OTCQX | #OVER-THE-COUNTER | #PINK SHEETS | #BULLETIN

Min 2:41:00 (2 hours) ------- LONGING multiday BREAKOUTS (OTCs) ---------------- TRADING TICKERS 1 --- Part 2 --------- https://members.timothysykes.com/lessons/trading-tickers-1-part-2 ........

Min 0:00:01 (2.66 hrs) ------ LONGING new stock promotions (OTCs) ----------------- TRADING TICKERS 1 --- Part 2 --------- https://members.timothysykes.com/lessons/trading-tickers-1-part-2 ........

When you start to string OTC wins together, that’s when your account can really start to grow. -Bohen

!!!!!!!!!!!!!THE KEY TO TRADING OTC STOCKS!!!!!!!!!!!!!!

Min 7:25 --------- Jack Kellogg played OTCs to really boost his account in the beginning --------- he buys every OTC that is up on the day and has volume ------- if it starts working, he keeps adding to his position (using Level 2, and key levels on the chart to keep averaging in), and once the breakouts start going you can make a lot of money (like $1k, $2k, $3k wins),,,, and if the breakout fails just cut for $100-$300 losses ------- the key is to get into the OTC stocks early before they breakout so you have some cushion ----- then once they breakout, that's when everyone else is buying so you can buy there ------ A lot of it comes down to the daily chart, and then the 15 day and 15 minute chart (to just kinda look at the bigger picture and story of the stock to find what it's done in the past, where it's gotten volume and broken out - to give me a guide to what it's gonna do when it breaks out this time (use the history of the stock to know what to expect) --------- https://youtu.be/E8fY9jUOMQc .........

!!!!!!!!!FOCUS ON OTCs AS A BEGINNER!!!!!!!!!!!!!!

Min 11:40 --------- www.youtube.com/watch?v=E8fY9jUOMQc ...........

- focus on the right time of day with OTCs -------- there's a lot of volume in the morning and there's a lot of volume near the close.

1. focus on good intra-day and daily charts (15-day | 15 minute)..

2. focus on buying near the close in the last hour or two (buy the stock into the close when it starts breaking out of consolidation, with volume)...

3. sell during the first hour the next morning (sell during the gap up the next morning)...

****I truly believe that OTCs, buying them late day and selling them into the gap up the next morning ----- is probably the best way to grow yourself out of PDT..........****BUY HOT SECTOR STOCKS, INTO THE CLOSE, THAT BREAKOUT OF CONSOLIDATION (AT THE END OF THE DAY BETWEEN 3-4 PM) ----- and sell into the morning spike............ and move on to the next play.... and don't trade mid-day and don't dip your toes into the listed stocks.........

****late in the day (jackaroo) buys a lot more shares because it's low odds that the stock will break support (line), and if it does he just cuts quickly..........but if you get that nice strong close, now you can even move your risk up from red to green the next day, so you can lock in double what you initially were risking...... and if it's gonna go and have the morning spike, you can make 4x 5x 6x your money...

****OTCs that finish strong on the day just have a wicked high odds percent for a small gap up (then it just depends if buyers come in)...... you rarely see OTCs gap down when they have a decent day and are up 10%, 15%, 20%, 40%, 50% on the day......... -Jackaroo

Min 23 -------- I won't even look at (an OTC) stock if it's below VWAP past 2 pm... I want the stock above VWAP and i want a super tight range going sideways (consolidating on a very tight range).... And when the stock breaks-out over the range with volume, I'm joining there (risking the low of the channel), and then if it creates a new channel I'm going to add in to where it breaks again (& move my risk up), and that's how i achieve 10:1 risk reward -------- www.youtube.com/watch?v=3ixs9hUwPgU .......... #Jackaroo

!!!!!!!!!FOCUS ON OTCs AS A BEGINNER!!!!!!!!!!!!!!

Min 11:40 --------- www.youtube.com/watch?v=E8fY9jUOMQc ...........

- focus on the right time of day with OTCs -------- there's a lot of volume in the morning and there's a lot of volume near the close.

1. focus on good intra-day and daily charts (15-day | 15 minute)..

2. focus on buying near the close in the last hour or two (buy the stock into the close when it starts breaking out of consolidation, with volume)...

3. sell during the first hour the next morning (sell during the gap up the next morning)...

****I truly believe that OTCs, buying them late day and selling them into the gap up the next morning ----- is probably the best way to grow yourself out of PDT..........

****late in the day (jackaroo) buys a lot more shares because it's low odds that the stock will break support (line), and if it does he just cuts quickly..........but if you get that nice strong close, now you can even move your risk up from red to green the next day, so you can lock in double what you initially were risking...... and if it's gonna go and have the morning spike, you can make 4x 5x 6x your money...

****OTCs that finish strong on the day just have a wicked high odds percent for a small gap up (then it just depends if buyers come in)...... you rarely see OTCs gap down when they have a decent day and are up 10%, 15%, 20%, 40%, 50% on the day......... -Jackaroo

OTCs [vs] LISTED

OTC stocks are very seasonal.... what's good about OTCs is you don't have to go against huge drawdowns...... I'd rather have my equity curve going up, and if there's nothing I'll just be going sideways (rather than trading a listed(Nasdaq) strategy where it's very consistent and there's opportunity everyday BUT you're going to be taking a lot more losses)....... IF YOU JUST CUT YOUR LOSSES QUICKLY ON THESE OTCs, there is no reason to lose a lot of money on them.... And if they do work, you can make a lot of money.... so (you) just need to stay patient with these OTCs (for plays)...... and I'm trying to learn some Listed setups in the meantime (over-extended gap-downs #shorting #TradingTickers focuses on this pattern)..... -Jackaroo

OTCs are excellent for growing a small account. . . . . buy before huge spikes. . . . OTCs heat up randomly during the year. . . . . NASDAQ Listed stocks are more consistent but you're more likely to also have bigger losses than with OTCs (so long as you're cutting losses quickly with OTCs). . . . . LEVEL 2 is essential to trade OTCs!

Almost all of my millionaire students became millionaires thanks to OTCs. . . -Tim Sykes

KEY ADVICE ---------- You should definitely focus on learning OTCs..... it's just so much easier than listed stocks....... Listed (NASDAQ) stocks are just a headache, and choppy, and it's really hard to make a lot of money.......... but with OTCs, if you catch the right one, you can make 30, 40, 50% on your money, and that could be huge for a small account........ Once you start to get a ton of profit and you're over PDT, you can start branching out to see if you're good at listed stocks....... OTCs are definitely the easiest in the whole entire market, and people just hate on them...that's where you should be focused...... -Jackaroo

I like to be super early on my trades...... so before the OTC stock even breaks out -- at like 20% 30% -- i like to get involved in a very small position......and if the stock starts dipping i sell it for a $100/$200 loss..... but if the stock starts working, now i have a $100/$200 win of unrealized profits, that i can now add to the risk, when I'm taking my real trade [during the time when other buyers starting coming in for it's spiking] (this allows jackaroo to invariably stay in the trade longer to let itself work out....... then he can really develop a plan and size in and find that key level in the chart)---- and my average is going to be so much lower than others because i started buying early....... [thus, part of his plan starts to develop as the stock starts to move; he reacts to the chart and gets a feel for the Level 2......].....

Level 2 is ultimately more important on OTCs (than for Listed(Nasdaq)), because it's easier to follow.......... (everything comes down to the Level 2........... if i can get a lot of size or not....... if the stock is really sketchy or the bid just drops off real quick then that means i can't take a lot of size on it b/c i don't want to take a lot of slippage on it)........ -Jackaroo

Min 29 ------ You CAN grow your account over PDT with OTCs (with listed stocks, it's difficult) ------ www.youtube.com/watch?v=E8fY9jUOMQc ........ -Jackaroo

Min 18 ------ it all comes down to risk/reward with OTCs ------- Level 2 doesn't lie when it comes to OTCs! unlike other listed exchanges / stocks -------- https://youtu.be/G1lHUwugw-A ........ #Jackaroo

Level 2 is ultimately more important on OTCs (than for Listed(Nasdaq)), because it's easier to follow.......... (everything comes down to the Level 2........... if i can get a lot of size or not....... if the stock is really sketchy or the bid just drops off real quick then that means i can't take a lot of size on it b/c i don't want to take a lot of slippage on it)........ -Jackaroo

Min 29 ------ You CAN grow your account over PDT with OTCs (with listed stocks, it's difficult) ------ www.youtube.com/watch?v=E8fY9jUOMQc ........ -Jackaroo

Min 18 ------ it all comes down to risk/reward with OTCs ------- Level 2 doesn't lie when it comes to OTCs! unlike other listed exchanges / stocks -------- https://youtu.be/G1lHUwugw-A ........ #Jackaroo

Level 2 doesn't matter with NASDAQ, but with OTC you can get a little bit of a read, and there's just much less competition in OTCs (average joes)...... in OTCs, you don't need to risk a lot of money, you just need to be right.. you don't need to risk money to make money in OTCs... care about how good the risk/reward is... not the setup........

Level 2 doesn't matter with NASDAQ, but with OTC you can get a little bit of a read, and there's just much less competition in OTCs (average joes)...... in OTCs, you don't need to risk a lot of money, you just need to be right.. you don't need to risk money to make money in OTCs... care about how good the risk/reward is... not the setup........

OTC's risk/reward is much better than what you'll find in Nasdaq(listed) stocks / exchanges because of the choppiness found in Nasdaq(listed) stocks/ exchanges. -[Jackaroo commentary]

OTC's risk/reward is much better than what you'll find in Nasdaq(listed) stocks / exchanges because of the choppiness found in Nasdaq(listed) stocks/ exchanges. -[Jackaroo commentary]

Min 21 ----- how to determine risk/reward w/ OTCs........ (use Volume, and previous history to know your risk level and where your entry should be --- https://youtu.be/3ixs9hUwPgU .... #Jackaroo #Bohen

Min 12:30 - Min 22 -------- how the framework plays out (OTC) | Swing Trades (afternoon spikes into morning gap ups) | Hot market vs Slow market ----------- www.youtube.com/watch?v=YrGfmhOA4J8......... !!!!!!!!!!!!!!!!!!!!!!!!!! #Dom

HOW THE FRAMEWORK PLAYS OUT WITH OTCs

When an OTC hits my radar/scan (from it running up) then:

1. PLACE IT ON MY WATCH LIST.... keep an eye on it, make sure you don't forget about the stock (maybe set an alert for when it does break a certain resistance level; getting in early on it is important)

2. Then it will have a red day.... AND IF IT HOLDS UP NEAR THOSE HIGHS, i want to buy it when it breaks over those highs (accompanied by news / catalyst)...

3. i really just want to play the breakout as long as the liquidity and volume is there...

4. if the breakout runs for 2-3 days, you can then SHORT-SELL the first red day.....

5. Then you can buy the panic (dip-buy it).... buy the bounce-play (strictly off the level 2 reading) and flip it with great risk/reward (zero risk)...

6. then if the stock does bounce and make a lower high for a day or 2, then you can SHORT-SELL IT AGAIN....

*OVERALL you'll have 3-4 chances on it playing out.... -DOM

Min 31 ------- the way Jackaroo makes the most of his money is ----- OTCs (multi-day runners: first green days, breakouts.... staying long for breakout, getting short for first red day, buying the panic and selling it into the bounce) --------- it's about understanding a ticker that can move clean in a multi-day fashion ---------- understand how a stock trades, and then the pattern that the stock is in at any given moment ---------------- www.youtube.com/watch?v=B38UxgTJGTA ..........

Min 32 ---------- OTC trading is much easier to learn than the Nasdaq market ------------ For beginners, I would start with OTCs because all you have to learn is technical analysis... With listed stocks, I would say it's an art, because you have to put together a story (like, the financials; is the company diluted; is the chart good; is there funding; what are the algos doing; how many shorts are trapped).. and there's so much more going on that it's impossible to even figure out "is this strategy even a trackable strategy", or is this just a bunch of different factors coming together.....

I would definitely start long for OTCs and I'd be super patient:

1. i would look only for plays near their highs at the end of the day that have just broken out to new highs.

2. first green days on a stock that have just run a huge percent and now it's had 2-3 red days and now it's having it's first green day (those are super high odds for them to continue into a morning spike).

*and i would just study study study... and take singles over and over again... and when you meet a market that matches your pattern you'll make exponential on that and you'll be out of PDT in no time....... www.youtube.com/watch?v=YrGfmhOA4J8......... #Dom

Min 22 --------- great plays to play in the OTC market --------- morning action (spike), you just watch it (don't chase), then 11 am - 2 pm it holds in it's tight range (consolidation) with a solid support level, then wait for it to breakout --- and you're in a great risk/reward situation (at around 2:30 pm you get in) ------- www.youtube.com/watch?v=YrGfmhOA4J8 .......... !!!!!!!!!!!!!!!

LISTED/NASDAQ [vs] OTC ----------- You need a lot more patience with OTC stocks, just cause they move slower ... Listed moves a lot faster. ...The patterns I trade on both are very very identical (just kind of how the stocks trade is different)... Listed (NASDAQ) stocks move a lot faster; a lot of times my trades are a lot shorter. . . OTCs might be a 1 to 2 hour trade --- i might be in a listed stock for like 3 minutes if it just instantly works. -Matt Monaco

First 1:30 minute -------- www.youtube.com/watch?v=0MoX68V1v_c ....... Dux explaining that OTC pumps don't really happen that often but when the OTC market heats up sympathy plays occur.... #Dux

Min 52 ---------- www.youtube.com/watch?v=l7w2IhPX5PY ..............

Min 27 ------------- OTC patterns to literally trade! ---------- www.youtube.com/watch?v=tuKEAiE1z_k ........... #OTCPatterns #connor

Min 33 -------- if a halt happens on an OTC, consider that you lost everything (that the price is going to open back up way lower) --------- www.youtube.com/watch?v=tuKEAiE1z_k ......... #Tuohey #Connor #HALTS #OTCs

Min 25:30 --------- OTC halts ------------- www.youtube.com/watch?v=EuYE4EB5wGE&t=3s ........ #grittani #OTCs #halts

Min 8 — great OTC pattern to play always — https://m.youtube.com/watch?v=LVry7VIt3gY ….. #OTCs #Sykes

Second :30 ------------ (at least in the current market environment) --- there are more LONGING opportunities than SHORT-SELLING opportunities when it comes to OTCs -------- www.youtube.com/watch?v=b1ZLu_NDooM ........ -Jackaroo #Bohen #shorting #OTCs

Min 10 ------- PROMOTERS are what makes the OTCs a hot market -------- www.youtube.com/watch?v=QhId_6ZWrjs ....... #Sykes #OTCs #promoter

_______________________________________________________________________

LISTED/NASDAQ [vs] OTC ----------- You need a lot more patience with OTC stocks, just cause they move slower ... Listed moves a lot faster. ...The patterns I trade on both are very very identical (just kind of how the stocks trade is different)... Listed (NASDAQ) stocks move a lot faster; a lot of times my trades are a lot shorter. . . OTCs might be a 1 to 2 hour trade --- i might be in a listed stock for like 3 minutes if it just instantly works. -Matt Monaco

First 1:30 minute -------- www.youtube.com/watch?v=0MoX68V1v_c ....... Dux explaining that OTC pumps don't really happen that often but when the OTC market heats up sympathy plays occur.... #Dux

Min 52 ---------- www.youtube.com/watch?v=l7w2IhPX5PY ..............

Min 27 ------------- OTC patterns to literally trade! ---------- www.youtube.com/watch?v=tuKEAiE1z_k ........... #OTCPatterns #connor

Min 33 -------- if a halt happens on an OTC, consider that you lost everything (that the price is going to open back up way lower) --------- www.youtube.com/watch?v=tuKEAiE1z_k ......... #Tuohey #Connor #HALTS #OTCs

Min 25:30 --------- OTC halts ------------- www.youtube.com/watch?v=EuYE4EB5wGE&t=3s ........ #grittani #OTCs #halts

Min 8 — great OTC pattern to play always — https://m.youtube.com/watch?v=LVry7VIt3gY ….. #OTCs #Sykes

Second :30 ------------ (at least in the current market environment) --- there are more LONGING opportunities than SHORT-SELLING opportunities when it comes to OTCs -------- www.youtube.com/watch?v=b1ZLu_NDooM ........ -Jackaroo #Bohen #shorting #OTCs

Min 10 ------- PROMOTERS are what makes the OTCs a hot market -------- www.youtube.com/watch?v=QhId_6ZWrjs ....... #Sykes #OTCs #promoter

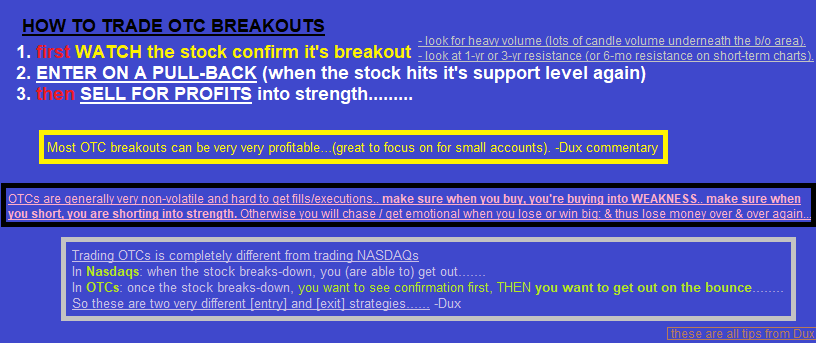

Min 33 -------- how to play OTCs!!!!!!!!! the best breakouts for OTCs are when it breaks-out over a high that was set in the last 20 days........ then it pulls back / goes red for a day or two (consolidates), then reclaims the breakout level (which should be your set risk level to sell if it goes below), and breaks-out (the profits you make) ----- www.youtube.com/watch?v=dAanETbgqNM .......... #PapaJohn

Buying OTC breakouts ...... and shorting over-extended gap-downs......... <------- Grittani's favorite 2 patterns to play.......... [Min 16: https://youtu.be/Vz0aoeT5bmA] ........

OTC multi-day breakouts are still the best thing to build your account...... be focused on the longs [OTC breakouts]........ I'd still be playing listed stock breakouts (on a more shorter time-frame)....... (& for shorting: the occasional over-extended gap-down........) -Grittani

Min 22:40 ----- how to use VWAP with OTCs ..... Jackaroo won't even look at an OTC stock that is below VWAP if it's past 2 pm [he wants the OTC ticker to be above VWAP and a super tight range going sideways [hugging VWAP].. and when the stock breaks-out over the range WITH VOLUME, he joins there (setting his risk to cut losses at the low of the consolidation channel, and if it creates a new channel, he adds in to where it breaks again, becoming his new risk level, and that's how he achieves 10:1 risk/reward] -------- www.youtube.com/watch?v=3ixs9hUwPgU ............. #Jackaroo

OTCs ---------- perfect closes on Friday often lead to awesome opens on Monday ------------ (gap ups) ------------- min 33 ------------------ www.youtube.com/watch?v=V8QS39_usz4 ........!!!!!!!!!!! #sykes

_______________________________________________________________________________________

SCANNING FOR OTC STOCKS

Since I've made most of my money trading OTC stocks, the first thing I do is set my filter to only pick up OTC or Pink Sheet stocks.

When scanning the OTC market, I set my scanner to find stocks that are trading above 500,000 in volume, priced above $0.05, priced below $5, and up more than 5% on the day. This will pull up a list of stocks that meet this criteria for the day. Next, I look at the daily charts. For example, I'll look for daily stock charts that are getting overextended, or perhaps close to a key breakout. If I like the chart, I add the stock to my watchlist.

From there, I prioritize what I'm most likely to play the following day. When the following day concludes, I decide which stocks to keep on my watchlist (based off their charts), which to remove, and then I start the whole process over again. There really is no more to it than this. I don't dig through filings, I don't analyze news releases, I don't worry about what the message board trolls are saying. It's all about the chart and the pattern for me. -Grittani

Min 28 ----------- HOW TO SCAN FOR OTCs ------ there are no FREE scans for OTCs, you must buy access to the scanners ------ I like to catch the OTCs once they're already running [top % gains] [more than 1000 trades on the day #liquidity] [more than $1m in Dollar Volume] [sometimes I'll scan for less than a penny] --------- www.youtube.com/watch?v=lquPOpnCBcc ........... #Monaco

OTC STOCKS TO SCAN FOR ----- Mariana trades OTCs that are trading more than 1 million in volume, and up 10% on the day, with some news (and chatrooms)..... MIN 26: www.youtube.com/watch?v=eOOAabO4PAk ...... Min 10: www.youtube.com/watch?v=v5Y4SRmirpM .........

OTC STOCKS TO SCAN FOR ----- Mariana trades OTCs that are trading more than 1 million in volume, and up 10% on the day, with some news (and chatrooms)..... MIN 26: www.youtube.com/watch?v=eOOAabO4PAk ...... Min 10: www.youtube.com/watch?v=v5Y4SRmirpM .........

HOW GRITTANI SCANS FOR OTCs [NIGHT SCAN]- he selects OTC, OTCBB markets- he selects stock types [(regular securities) (stock splits, fifth letter "D") (delinquent ones that missed a filing, fifth letter "E") (foreign stocks, fifth letter "F") (bankrupt stocks, fifth letter "Q")]- he scans for the last trade price to be greater than or = to a $.01 (1 cent)- he sets NO MAX PRICE- liquidity: he searches DOLLAR VOLUME (he cares about how much money was traded in the stock and not how many shares were traded): greater than or = to $500,000 worth of DAY'S DOLLAR VOLUME.- Percent change filter: he searches for stocks GREATER THAN 0% on the day.

HOW GRITTANI SCANS FOR OTCs [MORNING/INTRADAY SCAN]- he selects OTCs, OTCBB markets- greater than or = to $200,000 worth of DAY'S DOLLAR VOLUME- Percentage change: greater than or = to 3%

- max price less than or = to $0.0100 (1 cent)- Days trades (# of trades on the day): greater than or = to 30

_______________________________________________________________________________________

Min 27:30 — trade OTCs and trade LONG on them — https://m.youtube.com/watch?v=2DSuguymfK4 .... #Mariana (she is 95% OTC, and 90% long on them; she shorts "first red day" Nasdaqs rarely)...

CUT MY LOSSES SWITFLY AND QUICKLY WITH OTCs ------------ "Maybe more times than not, I'll cut before my initial risk is broken (he intuitively reads the stock's movement); I'll always buy back in if it goes over my entry. . . . This does not work for Nasdaq or else you'll lose all of your money". . . -Jackaroo

THE DIFFERENCE BETWEEN OTCs AND NASDAQ(LISTED) STOCKS DROPPING

OTC pull-backs tend to be a lot more severe, whereas with Nasdaq(listed) stocks it tends to be a more slow gradual fade.. -Grittani

OTC pull-backs tend to be a lot more severe, whereas with Nasdaq(listed) stocks it tends to be a more slow gradual fade.. -Grittani

Min 3:30 -------- buy BREAKOUTS on OTCs --------- holding overnight ------ is a very consistent pattern ------- www.youtube.com/watch?app=desktop&v=8l5l1xsPgmk ....... #GOODE #GRITTANI #SYKES

Gap up plays and breakout plays on OTCs are more reliable [than with listed/Nasdaq stocks]..... -Sykes with Michael Goode

Min 3:30 - min 7 ------- The best time to buy OTCs is late day (and selling the next morning)..... My favorite OTC patterns (breakouts between 1 cent and 10 cents; I'm looking to capitalize on that secondary spike after it consolidates after it's first spike; with a catalyst, massive volume, in a hot sector; i watch the 15 days 15 minute chart to assess the stock's potential (ideally it spikes, consolidates/goes sideways, and repeats this stair-step pattern).... when the range gets tighter, and volume starts to come in, the stock breaks-out...... [THE BEGINNING OF THE YEAR AND THE END OF THE YEAR ARE THE BEST TIMES FOR THE OTC MARKET] ----------- www.youtube.com/watch?v=n6VkslzWxSo .......... capitalize on the SECONDARY SPIKE (multi-day breakout)...... #Jackaroo

Min 3:30 -------- buy BREAKOUTS on OTCs --------- holding overnight ------ is a very consistent pattern ------- www.youtube.com/watch?app=desktop&v=8l5l1xsPgmk ....... #GOODE #GRITTANI #SYKES

Gap up plays and breakout plays on OTCs are more reliable [than with listed/Nasdaq stocks]..... -Sykes with Michael Goode

Min 3:30 - min 7 ------- The best time to buy OTCs is late day (and selling the next morning)..... My favorite OTC patterns (breakouts between 1 cent and 10 cents; I'm looking to capitalize on that secondary spike after it consolidates after it's first spike; with a catalyst, massive volume, in a hot sector; i watch the 15 days 15 minute chart to assess the stock's potential (ideally it spikes, consolidates/goes sideways, and repeats this stair-step pattern).... when the range gets tighter, and volume starts to come in, the stock breaks-out...... [THE BEGINNING OF THE YEAR AND THE END OF THE YEAR ARE THE BEST TIMES FOR THE OTC MARKET] ----------- www.youtube.com/watch?v=n6VkslzWxSo .......... capitalize on the SECONDARY SPIKE (multi-day breakout)...... #Jackaroo

OTC's are only hot when it's hot........ it's seasonal....... the OTC market is not always hot......... I'm always looking for panics on OTCs........ -Sykes

PLAYING AN OTC PATTERN PLAY --------- Something I look for to tell myself if the stock has good potential of breaking out again, is for the stock to hold half of its spike... So for instance, this spiked exactly a penny to $.03 cents... and then the stock came down and held $.02 cents for two days perfectly (as shown on the 15 day 15 minute chart)... And then when the stock had a morning spike on Wednesday, that's when i get interested because the stock has proven to me that it can hold half it's spike, the stock can go on a 3-day green streak (as shown in its first run), and so that's when i start nibbling a little bit and buying some shares near the late-day where it kinda broke over high-of-day (i bought a few shares).. and then the next day it had a small gap-up, and they dropped the press release, and as you can see, there on Thursday, massive massive massive volume came in.. Absolutely astronomical volume on the daily chart (this stock traded 75+ million shares)... that's just amazing to me... so then as it starts spiking, i added into my position and got in with 500k shares at about a 3-cent avg which was the breakout. I was risking break-even on it if it failed to breakout.. The stock kept going and i sold that for $.04 cents, and as you can see it went all the way to $.07 cents... I left a lot on the table. I made about $6,700... -Jackaroo

_________________________________________________________________________________________________________________________

OTC vs. LISTED (Nasdaq) ----------- www.youtube.com/watch?v=n6VkslzWxSo ............

- OTCs are a lot more fluid than Nasdaq stocks...........

- OTCs are slower (and easier to play as a result)....... Nasdaq's have more fundamentals involved........ OTC daily charts are easier to read.......

- OTCs are lower in price and better to trade!

- LATE DAY is best to play OTC stocks (and take profits in the morning when the second wave of buyers come in) ------ the summer is slow (as is mid-day).... end of the year and beginning of the year are best to play OTCs..........

Min 19 ----------- OTCs are all fundamentally worthless companies ------- i focus 95% on the technicals (money is moving these stocks) ---------- #GRITTANI --------- I'm just looking at the same predictable piece of the move every time -------- www.youtube.com/watch?v=mr9F5PADkV8&t=793s ........... .

OTCs move so much slower, and methodical that it's so much easier to find risk .......... Nasdaq's move faster ----------- www.youtube.com/watch?v=YrGfmhOA4J8 .........

Min 36 - Min 40 -------- technical analysis (OTCs) is easier to learn than fundamental analysis (listed stocks) ------ in OTCs, it's safer and easier to read the charts (cleaner charts)..... learn listed after you build your account with OTCs ------ www.youtube.com/watch?v=YrGfmhOA4J8 .......

OTC FILLS

OTCs are harder to get filled on. . . the percentage gains you can get on OTCs are easier (easier than listed (Nasdaq) stocks). . . .

OTC MOVERS

To see a 30% move on a hot OTC is almost like a joke (they have the ability to move 10x that). . . To get a 30% move in minutes on a Nasdaq is tough, so I would say (OTCs) are easier in that regard. .

OTCs are tough, you gotta really pick your spots carefully (entries/exits).... -Monaco

Min 1 ------------- if you're trading big with OTCs and there's not liquidity, it's dangerous ..........GRITTANI tips ----- https://youtu.be/Vz0aoeT5bmA ..........

As you take more and more size, especially on OTCs, it gets harder and harder to execute your orders........ Focus on singles........... -Jack Kellogg

Most of these OTCs will fail. . most of them are connected to promoters. . . . (the SEC shutting down these promoters will impact these other plays). . . .I want as much volatility as possible. . . . I'm just trying my best to take the meat of the move. . . Learn WHY am i trading this. -Tim Sykes

yo yo, for OTCs, the consensus is that i do not need to worry about SEC filings or financings or dilution or any fundamentals whatsoever.. The beauty about OTCs is that all I must focus on and acquaint myself with is the chart pattern (the technicals)... Grittani says that the chart and resistance/support levels plus the occasional catalyst/news is all that he only focuses on for OTCs specifically, (w/ Level 2 as an active fixture), and similarly for Jackaroo and Dom as well.... #dope.......

_________________________________________________________________________________________________________________________

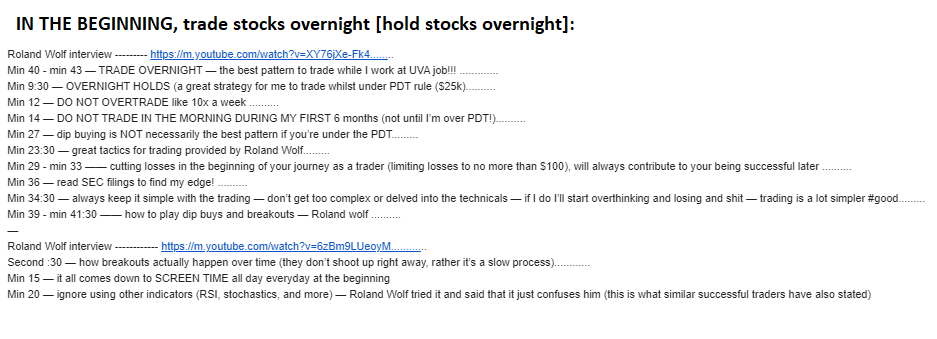

Min 9:30 — OVERNIGHT HOLDS (a great strategy for me to trade whilst under PDT rule ($25k).......... Roland Wolf --------- https://m.youtube.com/watch?v=XY76jXe-Fk4........ #OTCs

Read ------------- https://stockstotrade.com/strategies-for-trading-non-listed-stocks/?utm_source=Iterable&utm_medium=email&utm_campaign=campaign_2873800&email=saloul10%40gmail.com ......

Min 36 ------------- with OTCs i give no weight to the stories (fundamentals / actual breaking news).. i assume they're all junk, especially pump and dumps....... with listed stocks (NASDAQ), if something pops up I dive into the latest 10Q [to] see if there's a red flag (such as offerings)......GRITTANI tips ----- https://youtu.be/Vz0aoeT5bmA ..........

Do NOT confuse this OTC bubble with them being long-term investments; that’s what promoters want people to think... 99.9% of penny stocks fail and crash big in the long run so please be careful! This may appear to be a real research report [alternetsystemsinc.com/research-rpt/], but it's not, it's just a paid for advertisement and that's the case with nearly alllllllll these plays so be extra careful. -Sykes

You’ll see I get A LOT of crap for selling these Supernovas into strength, but that’s how I’ve traded for 20+ years and that’s how I teach (so hate on my strategy if you want, I’m not changing anytime soon, old Jews get more stubborn, not less)...and holding ANY OTC overnight in this environment (where promoted plays are getting halted) is dangerous. . . -Tim Sykes

___________________________________________________________________________________________

OTC DOWNSIDES (cons)

- Some of these companies can be years behind on SEC filings. The transparency just isn't there. The SEC filings can be useless, and too often, the company’s web page doesn't even work…

OTC UPSIDES (pros)

- Very loosely regulated, meaning OTCs can make HUGE moves because they’re often manipulated and promoted. If you know what to look for & how to ride the momentum, there’s plenty opportunity.

- They can also be great for new traders with small accounts since they’re mostly low-priced stocks.

___________________________________________________________________________________________

OTC TIPS -------- watch the Level 2 on OTCs as much as you can, and when there's volume -- it can be a good skill to be able to identify tops and bottoms in terms of level 2.... It's important to pull the trigger fast (otherwise you may not get filled)........ be quick on your feet buying bounces and identifying key levels of support and resistance...... that's the whole key...... buy early and sell into strength.... -Roland Wolf

Min 49 ---------- You can't walk away from the computer when you're trading OTCs......... You can't set a stop loss with OTCs...... with OTCs, you gotta pay attention, you have to stay at your computer watching the ticker...... because executions suck....... BTheStory isn't a big trader of OTCs... they're easier, but not easy for him and his lifestyle ------ https://youtu.be/NiODz8Ykg9U......-B The Story

"Do you play OTC stocks?"....... Not really. Every once in a blue moon, but more times than not, nope. Because i don't like just sitting at my desk having to watch it. I like to use stops, profit targets, and letting it just do it's thing. -B THE STORY

Min 5:30 ----------- Min 11 ------------ the odds of SLIPPAGE is high with OTCs ------ risk management with SLIPPAGE ------- www.youtube.com/watch?v=NiODz8Ykg9U ......... #BTheStory #OTCs

Min 51 --------- OTCs and Nasdaqs are different ------- you don't size in the same if you're switching over ---------- www.youtube.com/watch?v=NiODz8Ykg9U ........

Min 25:30 ---------- despite needing to pay commissions on OTCs (fees), (ETRADE CHARGES ABOUT $5 for OTC transactions), it's still very much worth trading OTCs because the % gains OTCs can make (is exponential) ---------- www.youtube.com/watch?v=lquPOpnCBcc ........... #Monaco

Min 3:20 ------ the key to trading OTCs successfully (the broker to use); E*Trade PRO - i must use................... www.youtube.com/watch?v=FiDQFTixAdA ............... #Monaco

Min 12 - Min 17 --------- OTCs premarket is usually not worth it due to a lack of Volume ------- (instruction on trading in OTC) ------ www.youtube.com/watch?v=FiDQFTixAdA ......... #Monaco

Min 11:30 --------- Min 31 ---------- www.youtube.com/watch?v=lquPOpnCBcc ------ learn from other traders........ ask them questions.......... this is how you increase your learning curve......... Talking to other traders, When OTC stocks are no longer hot, I'm able to learn what other traders are doing and succeeding with so i can make those transitions to then Listed stocks in that period of time which would happen to be trading well...... Talking with other traders gives you insights........ it's made me a better adaptor......... practicing all these different ways.......... #Monaco

Min 8:30 ------- OTC plays....... it's easier...... but you gotta know how to read Level 2....... gives a huge competitive advantage ------ www.youtube.com/watch?v=DbH7UYNNY08 ........ #MasonRiley

Min 43 -------- long OTCs.......... go long on OTCs..............Jackaroo wisdoms ---------- www.youtube.com/watch?v=MykQUXQ1Wus ................ #Jackaroo

Min 54 --------- Jackaroo made his first $100k on trading OTCs (buying, not shorting)........ his dad stayed thinking it was luck tho lol -------- www.youtube.com/watch?v=MykQUXQ1Wus .......... #Jackaroo

Min 4 ----------- Min 7 ------------ Min 8:10 [#GreenOTCstocks] ----------- www.youtube.com/watch?v=NKx2ZYkAj24 .............. #Sykes

Min 7 ------- OTCs panic big-time when they panic, thus getting out when it's panicking is essential and can be difficult | go with the trend/momentum of LEVEL 2 ------ Min 8 ------ OTC vs NASDAQ --------- www.youtube.com/watch?v=G1lHUwugw-A ............. #Jackaroo

A pro tip (when trading OTCs): it's important to watch on OTCs, which market makers are buying and selling shares (supporting the bid or really just hammering the ask)... -Monaco

KYLE'S FAVE OTC SETUPS --- panic dip buys.. i like overnight otc longs... another is a BREAKOUT and then taking it long overnight (not buying the breakout immediately, but waiting til the breakout holds into the end of day where i then buy during the last hour of the day and hold overnight (esp. when under PDT, looking for a day 2 continuation) -- min 19 -- www.youtube.com/watch?v=8dZNKvuRWNk .........i don't really trade listed longs cause i've lost money on them. Short-selling listed and OTCs have always been my favorite strategies…

Min 23:30 -------- December, January, February are the best months for trading OTCs typically (most liquid months!) | and then the rest of the year OTCs are dead unless there are hot runs in sectors, but overall OTCs are very seasonal ------ https://m.youtube.com/watch?v=cj4X2fgAuHk ……….. #OTCs #seasons

Min 20 ---- OTC land is the best (the stock tape just trends (up/down) and channels (consolidates) repeatedly -------------- www.youtube.com/watch?v=G1lHUwugw-A ........... #Jackaroo #BTheStory

B THE STORY: through this journey, what do you feel like is the biggest misconception that you used to have, about trading. . ?

JACKAROO: That i could take a massive short position on a Nasdaq stock like Dux and make bank. . . And i just found out that, like at first, I was like "oh yeah, I'm going to use centerpoint, I'm going to short these stocks and I'm going to make a bunch of money". . and then i just came to the realization that I'm just not comfortable with that much size, and in a Nasdaq stock because of how fast it can go against you. And now I just trade these little OTC stocks with light dollar volume, super conservatively, but when they're hot i can make a bunch of money and i can have very good risk/reward so. . . I always thought I was going to be a short-seller on Nasdaq, but I guess that I wasn't. . . So now I'm a short-seller in the OTC land, and I go long. . . OTCs. . yep! . . .It's been dry though, since April. But i found that there's one good play a week going long, and one good play short-selling per week. And i usually make a lot more money on the short because i have a lot more conviction and i take bigger risk, but on the longs I'll risk like $100 - $200 bucks and make like $500 - $1000. . . so that's why months aren't that big, just because i'm making $1k, $2k $3k per week. . . . my biggest week in the last 3 months is $2,600 bucks, but it's consistently making $1k - $2k per week which is pretty good. . . . .

Min 27 -------- you gotta stalk these stocks for days (to get these breakouts) --- OTCs------------ www.youtube.com/watch?v=G1lHUwugw-A .............. #Jackaroo

WHY kroyrunner ENJOYS TRADING OTC STOCKS------http://tradetheticker.blogspot.com/2014/03/question-why-do-you-prefer-trading-otc.html

1.The Level 2 Advantage ... Listed stocks have instant executions, so you do not get the same advantage from level 2.

2. Chart Patterns are More Reliable ... OTC stocks trade based off chart technicals far more than any kind of fundamentals.

Min 17 ------- more times than not I'll cut before my initial risk is broken..... & am usually always going to buy back in if it breaks high of day #OTCs ----- https://youtu.be/G1lHUwugw-A ...... #Jackaroo