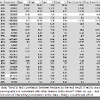

TRACKING STATS ------ Min 51:20----Min 1:12:45 ----- PART 4 ---- TRADING TECHNIQUES ....

https://www.youtube.com/watch?

https://www.youtube.com/watch?

- Track whether the stock is an IPO.......

- Was the stock a BIOTECH.........

- Track the # of pullbacks the stock had during it's pattern MOVE...........

- The percentage off the highTick that the stock pulled back (did it pull-back 15% off the high on it's first pull back? what % did it pullback on it's second pullback? etc.).

- What is the RISK/REWARD?

- did the stock dip below HALF IT'S FIRST LARGE SPIKE (if it held at 50% of it's spike or above it, then the BAGHOLDERS still have hope that it will spike up again; if it pulls back below 50% of it's spike then it is likely to fail on the bounce). <------A VERY IMPORTANT DETAILS TO TRACK...

- I must track the VARIOUS FLOATS and MARKET CAPS (track billion dollar floats and market caps, as well as low floats and micro caps) - i.e. TRACK ALL STOCKS THAT THE PATTERN PLAYS OUT ON.......

- what is the RISK/REWARD of the setup

‣ believe in the company

‣ don’t want to be wrong

‣ are too stubborn to take a loss.

‣ or they’d rather hold out and wait until they’re breakeven.

I almost never like day-one moves on bag-holder stocks. There could still be a ton of selling pressure. And that means more supply than demand.

That’s why I prefer to wait. I want to see multiple green days in a row to confirm ongoing demand. That indicates a shift in supply and demand. Until then, it’s a guessing game.

If you had a winning trade, congrats. But don't get greedy. If you don’t take profits into strength, you could become another bagholder. [#BAGHOLDERS #BAG-HOLDERS]

For me, First Green Days are great for risking LOW OF THE DAY. I've been trading FGDs for a long time now, and I know the best spot to risk for the highest chance of having a winning trade is LOW OF DAY. So LOW OF DAY is my risk (that's a good thesis)... First Green Days also don't always run the furthest because there's bagholders in there. -Monaco #FirstGreenDays #bagholders #FGDs

Min 37 --------- How to ensure a massive supernova spiker doesn't have many bagholders still in the stock (so it can keep spiking instead of selling off and tanking due to bagholders selling to break-even or minimize the amount of losses they're holding) -------- https://www.youtube.com/watch?v=zvs_8zF-i1E ..........

A stock can have only so many Float Rotations (only so many maximum number of times) before it drops back down in price. -[Dux commentary] #floatRotation #rotation

If you don't know where the top of a spike is going to be, always sell into the pre-market high (check the top tick in the pre-market and sell there)... -Dux commentary

The idea is I find a stock that’s shot up on news and then held near the highs.

That effectively ‘traps’ short sellers near their stops.

If a stock manages to drop, they get an opportunity to exit at a profit.

But when the stock holds near the highs, it makes them nervous with an itchy trigger finger.

And most of them put their stops right at the recent highs. -Bohen

A premarket breakout pattern can be a pattern that appears on a FIRST GREEN DAY chart... -[Dux commentary]

- Does the stock have good news?

- How has the stock reacted to good news historically? (explain the consistent next 5-10 day candles following the stock's supernova/spiking)

- how many [MINUTES] the stock consolidated at its SRL levels of resistance before SPIKING up further. (1-min candles, or 2-min candles, or whatever candles!)

- how much [VOLUME] the stock had CREATED DURING THAT SMALL CONSOLIDATION WINDOW while consolidating at it's SRL levels of resistance, before SPIKING up further (what was the TOTAL VOLUME during that period of consolidation)

- how much [VOLUME] TOTAL the stock had up to the point where it BEGAN CONSOLIDATING, PRIOR TO IT'S BREAKOUT ABOVE SRL levels of resistance.

- what the BREAKOUT %gain was of the stock (what percentage did the stock spike?), when it broke out above SRL LEVELS OF RESISTANCE.

- how many minutes the stock consolidated at it's SRL levels of resistance before DIPPING/TANKING back down to support levels. (1-min candles, or 2-min candles, or whatever candles!)

- how much [VOLUME] the stock had CREATED DURING THAT SMALL CONSOLIDATION WINDOW while consolidating at it's SRL levels of resistance, before DIPPING/descending downward back to support levels (what was the TOTAL VOLUME during that period of consolidation)

- how much [VOLUME] TOTAL the stock had up to the point where it BEGAN CONSOLIDATING, PRIOR TO IT'S then DIPPING/TANKING/descended downward under SRL levels of resistance.

- what the DIPPING/TANKING %loss was of the stock, when it DESCENDED below the SRL LEVELS OF RESISTANCE.

- what time it was when the stock hit its level of resistance, and then DIPPED/TANKED/descended downward.

- did the stock hold HALF ITS GAINS (from the point of when it began its run up/ascension/spiking) when it began dipping back to its initial spiking point? (if it held half it's gains, this is a bullish signal)

- did the stock hold its EMA20?

- did the stock hold VWAP?

- what EMA did the stock actually hold? (go through all the EMAs (5)(9)(50)(200) to determine which EMA the stock actually held yo.......... and NOTATE THIS........

BREAKOUTS

I wouldn’t chase it now, even though technically it’s a breakout, but

it’s had three big green days, really two big green days in a row. I don’t like

buying on a third green day. I like buying the first green day over a previous

breakout.

That’s not to say that a breakout is going to fail on day two or day

three. I just don’t like it. I prefer day one breakout.

So in a perfect world, you get a breakout over the previous highs with

one big green candle, and then most likely it’s going to create a second green

candle.

-

FIRST GREEN DAY PATTERN [Bootcamp Day 14: Penny Stock Patterns – First

Green Day]

What are the indicators of the First Green Day Pattern?

* Big percent gainer,

with news, with a catalyst, ideally finishing strong into the close.

Why are OTC FGDs more predictable than listed?

* OTCs don’t trade

during extended hours trading.

What informational inefficiencies can lead to the FGD pattern?

* Most people aren’t

interested in penny stocks so they don’t see the news until long after it’s

released. Sometimes by a matter of days.

Why doesn’t the First Green Day Pattern happen in other niches?

* In efficient markets,

news doesn’t move stocks in a big way.

Key Point: It’s Not Just Any First Green Day ========== The first green

day pattern doesn’t refer to just any stock that’s experiencing a first green

day. There are key indicators a trader should look for, like volume, a big

percent gain, and a catalyst.

-------You want it to

mean something. You want the news, you want the big percent gain. It’s kind of

a sign. It’s a forward indicator that, “Oh, this stock is doing something. This

company is doing something.”

With penny stocks, there are thousands of stocks. They all claim to have

amazing technologies, amazing products, but most of them are full of BS. And

even if they’re full of BS, it doesn’t matter. They’re irrelevant. They don’t

trade enough. Their stock doesn’t move enough. You just have to ignore

them.

But if they start spiking with big volume and ideally news and a big

percent gain, then they’re on a lot of traders’ radars. That’s what I love

seeing. I love seeing that first green day, no matter what the news is.

They can hype themselves up however they want, but it shows that they

want to either pump themselves up or maybe a group of traders wants to pump

themselves up. Then insiders can dump or maybe they can do a financing, but it

starts with one green day.

That tells you that something’s up. Usually, it leads to a second green

day or a third green day, especially if the news is good enough. Remember most

people don’t follow penny stocks. This niche is very inefficient with

news.

Key Point: A First Green Day Can Lead to More Green Days ===========

With penny stocks, a first green day can lead to additional green days. This is

because many people don’t follow penny stocks, so they can continue to build

momentum as more traders notice the price action and see the news.

So you can have the best news on day one and most people aren’t even

going to see it because they’re not really interested in penny stocks. But

they’ll see it on day two, day three, sometimes even day seven after some

article or maybe an analyst upgrades the stock. But it’s not all about breaking

news.

So for me, if I’m aware of this informational inefficiency, there’s a

lot of room for error. And there’s a lot of margin for me to buy a stock on day

one into the close as more people see it, especially on day two.

Also with OTC stocks, they don’t trade premarket. So if anybody sees the

news overnight, they can’t do anything except buy it the next day, and all the

buy orders stack up at the market open.

Key Point: OTC Stocks Don’t Trade Premarket ========= This is almost an

informational inefficiency ‘multiplier’ because when traders or investors see

the news overnight, they want to buy. This makes the first green day pattern

more predictable for OTCs.

The first green day (FGD) pattern is one of my favorites. One big

advantage of this pattern is that if you hold overnight, it doesn’t count as a

day trade. So for accounts under the PDT rule, this can be a good pattern to

help grow your account. But understand the nuances, because holding overnight

isn’t always the smartest option.

Most penny stocks aren’t followed by mainstream media and big-time

traders. So it can take several hours or days for anyone to notice the news or

price action. At the same time, many penny stock companies spike on hype and

hope. This informational inefficiency often leads to multiple green days in a

row. More about informational inefficiencies in a bit…

The First Green Day pattern is more predictable with OTC stocks. Why?

OTC Stocks Don’t Trade Premarket..... Because with listed stocks, you never

know what will happen in extended-hours trading.

If you hold the FGD pattern overnight on a listed stock, you need to be

present during extended hours. You need the ability to trade in extended hours

and watch the stock to protect yourself. .............

Less meticulous, uneducated traders see the price action/news after

hours. They get interested — but the market’s closed. So they place a market

order that gets executed at the market open. This can create a gap-up — where

the opening price is higher than the closing price. ...........

For this reason, an overnight hold on the FGD pattern tends to be more

reliable with OTCs.

I don’t buy any random spiking stock. This is especially true with the

FGD pattern. The first green day needs to mean something. You have to look at

volume, the catalyst, and how much it’s up on the day.

For FGD overnight holds, the time of day is also important. If a stock

spikes in the morning and proves it can hold at, or near, the highs all day,

it’s a good candidate. Especially if it’s closing strong. But if it spikes

100%, drops 50%, and sputters the rest of the day … it hasn’t proved

itself.

One other thing we didn’t mention in the video … I look at the stock’s

history. If it has a history of failed one-day spikes, I’m much less likely to

buy the first green day. Or if I do, I’m less likely to hold overnight. Again,

the news and volume influence how I trade a first green day stock.

-

The First Green Day Pattern Doesn’t Happen in Other Niches

In an efficient market,

the news doesn’t move stocks in a big way. Often, news is already ‘priced in’

to higher-priced stocks. Even if it’s not priced in, the spikes aren’t as big.

You rarely see examples where a high-priced stock doubles in a matter of

days.

With penny stocks, not

only does it happen, it happens frequently. Again, it’s due to informational

inefficiencies.

-

1] 1st Green Day Stock Pattern: What Is It and How Do I Take Advantage

of It? (6 minutes) --------- https://www.youtube.com/watch?v=1oOcAMIFUMA

................

2] First Green Day OTCs: A Pattern Every Trader Needs to Know! (11

minutes) --------------- https://www.youtube.com/watch?v=UWIE6HV6F_0

...............

3] My FAVORITE Way to Trade First Green Day Stocks --------------- https://www.youtube.com/watch?v=xzTc91MzT9s

.............

-

Determine which, if any, fit the criteria for the first green day

pattern. Remember to look for…

* Big volume. It will

be much higher than the stock’s average daily volume.

* A big percent gain.

The stock should be up 20%, 30%, 50% … maybe even 100% on the day.

* Figure out the

catalyst. What’s influencing traders to buy? How much time elapsed between the

news release and the stock’s run?

* Depending on the time

of day when you complete this task: Did the stock close strong? Is it closing

strong?

What if a top percent gainer is not on its first green day but the stock

has run for multiple days? Look to see if there was a clear FGD as part of the

runup. To determine this you’ll need to look at a chart with daily candles —

say a three-month chart. If you find the stock did have a clear first green

day, what was the catalyst?

-

So keep in mind where the stock had come from over the past few weeks

and months. And recognize day two, day three run-ups have a lower probability

of success than a first green day, day one breakout.

-

Finally, remember that a first green day breakout is much more

convincing than a second green day. Especially if the stock is already up a lot

from its recent lows. It’s almost like the stock becomes top heavy. Many second

green day breakout attempts fail. Not all … but it lowers the chance of

success.

-

First green day breakouts are more reliable than second green day

breakouts.

* True: second green

day breakouts fail more often. Especially if the stock is already up a lot from

its recent lows.

-

You could have bought in the last hour of the day on the first green day

— a pattern that I know and love — bought it in the $0.20s, and sold it the

next day at the open at 55 cents or 60 cents. What would basically double your

money, which is what he did.

-

Key Point: Tim’s Patterns Play Out in Hot Sectors ======= Tim’s favorite

patterns, like the first green day pattern you learned on Day 14, work well in

hot sectors. However, you have to be nimble, because stock prices can move fast

in a volatile market. Remember, no one stock matters. Look for similar price

action.

-

Task 2: Start Testing and Tracking Today

Tim Grittani is arguably the best penny stock trader in the world.

He tracks and tests meticulously. Grittani’s speech at the 2018 Trader

& Investor Summit is very revealing. He showed detailed data about the

first green day pattern.

[www.youtube.com/watch?v=iCgzP0xRgrY]..............

The amazing thing is he’d never traded it. He wanted to know if the

pattern would give him an edge. He’d heard me talking about it so much he

thought it was worth testing it. So he set clear criteria and tracked first

green day stocks for several months.

Even after presenting his findings at the conference, he said he needed

more data. That’s meticulous.

-

Or a first green day

OTC play where it has a big percent gain, a news catalyst, and people are going

to see it overnight. [OTCs don’t trade premarket so it’s going to probably gap

up and morning spike the next day.

-

Min

00:00:01 (1.5

hrs) ------ FRONTSIDE short setup | shorting LOWER HIGHS INTO SPIKES (i.e.

shorting stocks that are still green on the day, and getting very extended )

--THESE ARE PLAYABLE BUT DANGEROUS SETUPS B/C A STOCK THAT IS STILL GREEN ON

THE DAY [ESP. ON DAY 1] CAN EASILY CONTINUE SPIKING ---------- don't look for

scalp opportunities; instead, look for substantial pull back plays) ----- NEVER

SHORT ON FIRST GREEN DAYS ---------

TT2 (Chapter 5) -------

https://members.timothysykes.com/lessons/trading-tickers-2-chapter-5/ ......

-

[1] First Green Day: the stock gaps up (over

100%) hugely in the morning [even if it did

nothing for 1 whole yr prior; even if it traded very lil volume over the past

two years]

-

Min 3:33:00 -------- First Green Day, Second Green

Day, Third Green Days --------- PART 2 ------

www.stevenduxi.com/trading-techniques-video-course/?_login=ddc225352a

...........

how to find a #First Green

Day -------

https://twitter.com/StocksToTrade/status/1615759722971267095?s=20&t=2iC6N8jllhR2vX1RFMwA2A

..........

2. First green day spikes with news (this

happens at 3:30 pm) <-------------------- MARKET CLOSE

-

-

A "first green day" means a stock is trading

higher than it closed at on the previous day [Min

9:30 — https://bit.ly/3uPoCjI]....

[so if a stock closed at $5 per share Monday and was trading at $6 per share on

Tuesday, it’s considered a “first green day"]... the green day I

look for typically follows a green day after multiple red days. First green

days are all about big percent gainers with high volume. -Monaco #PLAYS

-

Min

3:33:00 -------- HOW TO PLAY First Green Days, Second Green Days, Third Green

Days --------- PART 2 ------

www.stevenduxi.com/trading-techniques-video-course/?_login=ddc225352a

...........

-

My

recent success stems from the decision to only focus on the three long

strategies that I completely understand. Those patterns are: breakouts, first green

days, and morning panics. **Update 12/1/2020** I rarely buy morning panics

anymore. Anything else, I ignore. It’s as simple as that. Let me mention that I

do understand short selling pretty well, but in my opinion, if you are looking

to grow a small account, which I’m certain that most people reading this are in

that position, you must focus on going long. Everyone sees the success popular

short sellers like Tim Grittani and Steven Dux have had and want to emulate

that, myself included early on in my trading career, but their situation is

different from yours. They are trading very large accounts and have access to

shares of the stocks that are actually worth shorting. You on the other hand

are going to have a hard time finding those shares. So, don’t waste your time

early on trying to be a short seller, but you must understand how a short

seller thinks. When you can put yourself in the mind of a short seller, you can

take advantage of certain setups that make shorts uncomfortable leading them to

cover their shares which is called a short squeeze. You’ll also be able to

understand when shorts are likely to come in on a particular play so that you

can take profits. Furthermore, going long generally offers more upside. If you

go look at my trades, I have a decent amount of 30, 40, 50+ % winners. That

type of upside is possible quite often. As for shorting, the percent gains are

generally much lower. ............ Now, I don’t just buy any breakout, or

any first green day, or any morning panic… I’m looking for very specific

variations of those patterns with other catalysts working in my favor so that I

can give myself the best odds of success. I won’t get into all the specifics

because it is a lot of information to cover and doesn’t quite fit the scope of

this particular blog post; however, if I get enough requests, I will consider

future blog posts delving deeper into the specifics of the patterns I trade and

may even consider doing some video lessons. But that is all going to depend on

demand, so if you’d like me to contribute more content, please like this post

and leave a comment below mentioning what you’d like me to discuss. -MASON

FECHT

-

Min 3 ---------

Min 7 -------- www.youtube.com/watch?v=kK2yp8wOCFg ------- I'm always looking

for pre-market percent winners, and throughout the day... remember former

supernovas..... former runners, along with percent winners, along with good

catalysts, makes it a good buy...... because i know these patterns inside and

out I'm prepared.... You have one job --- LEARN THESE PATTERNS inside and

out..... Huddie studied for 2 years before he started getting consistent

profits..... this thing takes a little while..... but if you stick with me, if

you trust me, you will see results..... I don't like chasing stocks on the

third or fourth green day (even the 2nd green day for me; i have trouble

holding it on the first green day).... -Sykes ........ #WATCHLIST

-

Monday gap-ups are

notoriously known for being very good in spiking (when consolidation with

volume happens on Fridays based on a stock's being up from a First Green Day a

couple of days prior at the least), so long as it holds on Monday morning over

the previous Breakout leve. . . -[Marianna commentary] #mondays

-

I don't run nightly scans.. I run scans

throughout the whole trading day, as I'm trading, and I keep a running

watchlist of potential stocks... A first green day pattern list; a breakouts

pattern watchlist... And I find these stocks through the scanner... I run these

scans mid-day so I can watch how the stock is acting; these stock's have

personalities and if you can see how they trade just by watching it and getting

that screen time, it's gonna give you a leg up over everyone else... -Matt

Monaco

-

Morning dip buys in the morning (circa 9:45), morning spikes with news,

multi-day breakouts [Sykes doesn't like first green day BIOTECHS]

--------- these are the patterns sykes likes ........ Get in tune with the

patterns, and then SCALE UP ------------ www.youtube.com/watch?v=B_8YgFMq3TY

...........

-

Min 4 ----- when you have

a MASSIVE FIRST GREEN DAY chart that consistently downtrends, 60% of the time

you'll have a SECOND GREEN DAY ----- www.youtube.com/watch?v=RbHDkCTdUT4

....

-

"Sometimes, first green days don't work

(currently, less than 5% of them are working, and when they don't work they

usually lead to 10%-20% panics right away). Often times, you have to adapt to

the market. Welcome to the market.. . . The patterns do what they want. Start

to learn your favorite patterns, start to adapt and figure out what you're best

at.. . . I really like mornings panics. That's my favorite pattern.. . . .I'm

always judging (and Jackaroo) is always judging different patterns relevant to

the current market environment." -Sykes

-

Strategy---------- TYPICALLY, first red days are

potential shorting opportunities (especially on pump-and-dumps)... and

First green days are potential long opportunities..... -tim sykes

2) Buy the first green day, on a former runner, or an OTC with big volume, with big catalysts (BUYING FIRST GREEN DAY)...........

Min 10:30 ----- all I need to do is trade LONG-BIAS patterns ------ BREAKOUTS | DIP-BUYS | FIRST GREEN DAYS.......... master these 3 patterns! by watching Sykes' videos ------ JACK KELLOGG ----- www.buzzsprout.com/1196801/6312178-episode-17-jack-kellogg-on-creating-the-right-environment-for-yourself...........

3. The first green day in a hot sector stock: This pattern can offer multiple opportunities throughout the day.

Some patterns will work better at certain times based on market environment. First Green days will not always work consistently in the same way, nor will dip buys, nor will OTCs (where the market transitions from hot to cold, volatile to non-volatile).

ADAPT TO THE MARKET AND THE PATTERNS THAT ARE

HOT.

I don’t love sketchy biotechs, especially on their [first green day]. These sketchy companies are known to drop offerings to take advantage of their increased stock price. And that usually sends the stock off a cliff. No thanks. To me, it’s not worth the risk... If you just can't resist these sketchy biotech trades — all I can say is wait until the afternoon. -Bohen #biotechs #firstGreenDays #offerings

Green/red (or going red on the day, going green, red/green) — This indicates that a stock is going above or below its prior day’s close. So if a stock goes green today it has just gone above yesterday’s close. If it has just gone red it has gone below yesterday’s close. Whether a stock is up or down for the day has a significant psychological influence and it can inspire fear or greed. This is most true with penny stocks which are usually traded by unsophisticated individual investors... -Michael Goode

I will not trade a FGD unless it has really good volume (I will not swing or hold overnight unless it has really good volume) -Mason Fecht

MINUTE 40 ------- FOCUS ON BREAKOUTS | FGD | AND DIP-BUYING OVER-EXTENDED STOCKS THAT HAVE BEEN RUNNING SEVERAL WEEKS & THEY DROP 50% ------- https://youtu.be/RAkEKHCvph4 ........ #MasonFecht

Min 2 ---------- Min 5 – Min 7:15 -------- during a bear market, only hold WINNING TRADES overnight | + patterns to look for during bear markets ---- www.youtube.com/watch?v=q_4cYWYUzpA …….. #environment #bearMarket #recession #patterns #overnight holds

- TRACK::::::::: did the stock rid of all of its BAGHOLDERS when it gapped/spiked? [Min 20:40 | Min 30:30 | Min 36 - Min 40 | Min 50 | Min 58 -- https://youtu.be/zvs_8zF-i1E]

- When tracking VOLUME, always track both of these:::::: [VOLUME in premarket] and [VOLUME end of day].......

- What was the stock's OPEN price?

- What was the stock's CLOSE price?

- What was the stock's HIGH TICK price?

- What was the stock's LOW TICK price?